Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is MiX Telematics Limited (NYSE:MIXT), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

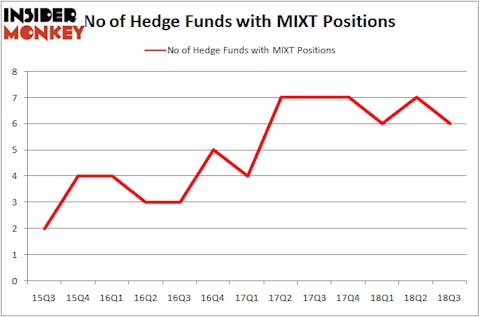

MiX Telematics Limited (NYSE:MIXT) investors should be aware of a decrease in support from the world’s most elite money managers of late. MIXT was in 6 hedge funds’ portfolios at the end of the third quarter of 2018. There were 7 hedge funds in our database with MIXT holdings at the end of the previous quarter. Our calculations also showed that MIXT isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a peek at the fresh hedge fund action encompassing MiX Telematics Limited (NYSE:MIXT).

What have hedge funds been doing with MiX Telematics Limited (NYSE:MIXT)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MIXT over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in MiX Telematics Limited (NYSE:MIXT) was held by G2 Investment Partners Management, which reported holding $15.2 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $14.8 million position. Other investors bullish on the company included ACK Asset Management, Polar Capital, and Millennium Management.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Manatuck Hill Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified MIXT as a viable investment and initiated a position in the stock.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as MiX Telematics Limited (NYSE:MIXT) but similarly valued. We will take a look at T2 Biosystems Inc (NASDAQ:TTOO), Immersion Corporation (NASDAQ:IMMR), Federated National Holding Co (NASDAQ:FNHC), and Geron Corporation (NASDAQ:GERN). All of these stocks’ market caps resemble MIXT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTOO | 14 | 48496 | -3 |

| IMMR | 16 | 102276 | -1 |

| FNHC | 8 | 42433 | 2 |

| GERN | 8 | 3819 | 0 |

| Average | 11.5 | 49256 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $49 million. That figure was $43 million in MIXT’s case. Immersion Corporation (NASDAQ:IMMR) is the most popular stock in this table. On the other hand Federated National Holding Co (NASDAQ:FNHC) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks MiX Telematics Limited (NYSE:MIXT) is even less popular than FNHC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.