Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Is Mimecast Limited (NASDAQ:MIME) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

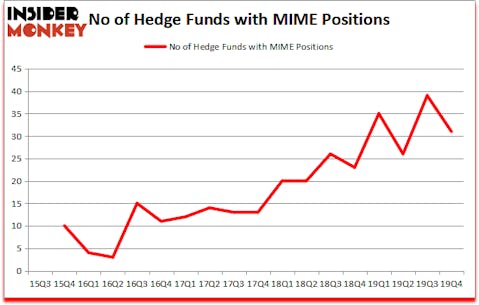

Is Mimecast Limited (NASDAQ:MIME) the right pick for your portfolio? Money managers are getting less optimistic. The number of bullish hedge fund positions were trimmed by 8 recently. Our calculations also showed that MIME isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). MIME was in 31 hedge funds’ portfolios at the end of December. There were 39 hedge funds in our database with MIME positions at the end of the previous quarter.

At the moment there are numerous methods shareholders can use to appraise their holdings. Some of the best methods are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass the S&P 500 by a significant margin (see the details here).

Colin Moran of Abdiel Capital Advisors

Keeping this in mind let’s take a look at the recent hedge fund action surrounding Mimecast Limited (NASDAQ:MIME).

Hedge fund activity in Mimecast Limited (NASDAQ:MIME)

Heading into the first quarter of 2020, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from one quarter earlier. On the other hand, there were a total of 23 hedge funds with a bullish position in MIME a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Abdiel Capital Advisors was the largest shareholder of Mimecast Limited (NASDAQ:MIME), with a stake worth $159.8 million reported as of the end of September. Trailing Abdiel Capital Advisors was Whale Rock Capital Management, which amassed a stake valued at $153.6 million. SQN Investors, SCGE Management, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Abdiel Capital Advisors allocated the biggest weight to Mimecast Limited (NASDAQ:MIME), around 9.99% of its 13F portfolio. Hunt Lane Capital is also relatively very bullish on the stock, earmarking 8.25 percent of its 13F equity portfolio to MIME.

Judging by the fact that Mimecast Limited (NASDAQ:MIME) has faced declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of hedgies that decided to sell off their entire stakes in the third quarter. Intriguingly, Anand Parekh’s Alyeska Investment Group cut the biggest investment of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $21.1 million in stock. Bernard Selz’s fund, Selz Capital, also sold off its stock, about $6.2 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 8 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Mimecast Limited (NASDAQ:MIME). We will take a look at Bill.com Holdings, Inc. (NYSE:BILL), Summit Materials Inc (NYSE:SUM), LCI Industries (NYSE:LCII), and Cronos Group Inc. (NASDAQ:CRON). This group of stocks’ market valuations are closest to MIME’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BILL | 32 | 310930 | 32 |

| SUM | 35 | 454382 | 8 |

| LCII | 17 | 127058 | 1 |

| CRON | 10 | 90321 | -2 |

| Average | 23.5 | 245673 | 9.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $246 million. That figure was $734 million in MIME’s case. Summit Materials Inc (NYSE:SUM) is the most popular stock in this table. On the other hand Cronos Group Inc. (NASDAQ:CRON) is the least popular one with only 10 bullish hedge fund positions. Mimecast Limited (NASDAQ:MIME) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th but still beat the market by 5.5 percentage points. Hedge funds were also right about betting on MIME, though not to the same extent, as the stock returned -22.2% during the first two and a half months of 2020 (through March 25th) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.