The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Middleby Corp (NASDAQ:MIDD) and find out how it is affected by hedge funds’ moves.

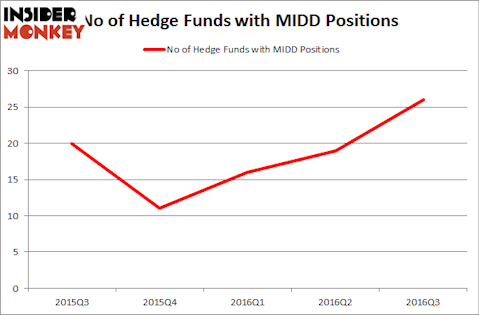

Middleby Corp (NASDAQ:MIDD) was in 26 hedge funds’ portfolios at the end of September. MIDD shareholders have witnessed an increase in hedge fund interest recently. There were 19 hedge funds in our database with MIDD positions at the end of the previous quarter. At the end of this article we will also compare MIDD to other stocks including DDR Corp (NYSE:DDR), EnCana Corporation (USA) (NYSE:ECA), and DexCom, Inc. (NASDAQ:DXCM) to get a better sense of its popularity.

Follow Middleby Corp (NASDAQ:MIDD)

Follow Middleby Corp (NASDAQ:MIDD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Keeping this in mind, let’s take a look at the fresh action regarding Middleby Corp (NASDAQ:MIDD).

What does the smart money think about Middleby Corp (NASDAQ:MIDD)?

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a jump of 37% from the previous quarter. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, OZ Management, run by Daniel S. Och, holds the largest position in Middleby Corp (NASDAQ:MIDD). According to regulatory filings, the fund has a $109.1 million position in the stock, comprising 0.6% of its 13F portfolio. The second largest stake is held by Columbus Circle Investors which holds a $38.7 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Israel Englander’s Millennium Management, Matthew A. Weatherbie’s Weatherbie Capital and Greg Poole’s Echo Street Capital Management.