Is Microsoft Corporation (NASDAQ:MSFT) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments (for some reason media paid a ton of attention to Ackman’s gigantic JC Penney and Valeant failures) and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Is Microsoft Corporation (NASDAQ:MSFT)’s case, the best stock pickers are turning less bullish. The number of bullish hedge fund positions was trimmed by five lately. At the end of this article we will also compare MSFT to other stocks including Exxon Mobil Corporation (NYSE:XOM), Berkshire Hathaway Inc. (NYSE:BRK-B), and Amazon.com, Inc. (NASDAQ:AMZN) to get a better sense of its popularity.

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

To most shareholders, hedge funds are assumed to be slow, outdated investment tools of the past. While there are over 8,000 funds trading today, Our experts look at the elite of this club, about 700 funds. It is estimated that this group of investors control bulk of all hedge funds’ total asset base, and by tracking their top picks, Insider Monkey has unsheathed a few investment strategies that have historically exceeded Mr. Market. Insider Monkey’s small-cap hedge fund strategy outrun the S&P 500 index by 12 percentage points annually for a decade in their back tests.

drserg / Shutterstock.com

Keeping this in mind, we’re going to take a look at the fresh action encompassing Microsoft Corporation (NASDAQ:MSFT).

How are hedge funds trading Microsoft Corporation (NASDAQ:MSFT)?

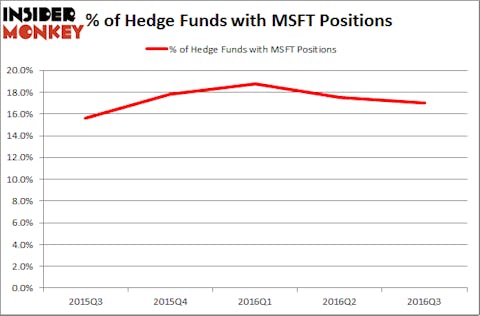

Heading into the fourth quarter of 2016, a total of 126 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 4% over the quarter. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, ValueAct Capital, managed by Jeffrey Ubben, holds the largest position in Microsoft Corporation (NASDAQ:MSFT). ValueAct Capital has a $2.22 billion position in the stock, comprising 19.4% of its 13F portfolio. The second-largest stake is held by Eagle Capital Management, led by Boykin Curry, holding a $1.64 billion position; 7.1% of its 13F portfolio is allocated to the company. Some other peers with similar optimism contain Ken Fisher’s Fisher Asset Management, David Blood and Al Gore’s Generation Investment Management and Stephen Mandel’s Lone Pine Capital.

Since Microsoft Corporation (NASDAQ:MSFT) has experienced declining sentiment from hedge fund managers, logic holds that there exists a select few funds that decided to sell off their entire stakes in the third quarter. First Eagle Investment Management cut the biggest stake of all the hedgies followed by Insider Monkey, worth an estimated $1.20 billion in stock, and Barry Rosenstein’s JANA Partners was right behind this move, as the fund cut about $353 million worth of shares. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by five funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Microsoft Corporation (NASDAQ:MSFT). We will take a look at Exxon Mobil Corporation (NYSE:XOM), Berkshire Hathaway Inc. (NYSE:BRK-B), Amazon.com, Inc. (NASDAQ:AMZN), and Johnson & Johnson (NYSE:JNJ). This group of stocks’ market valuations resemble MSFT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XOM | 59 | 2828791 | -1 |

| BRK-B | 74 | 20315727 | -4 |

| AMZN | 150 | 20794328 | 5 |

| JNJ | 82 | 5146011 | 0 |

As you can see these stocks had an average of 91 funds holding shares at the end of September and the average amount invested in these stocks was $12.27 billion, which is lower than the $18.14 billion in Microsoft’s case. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table, with 150 funds reporting long positions. On the other hand Exxon Mobil Corporation (NYSE:XOM) is the least popular one with only 59 bullish hedge fund positions. Microsoft Corporation (NASDAQ:MSFT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Amazon.com, Inc. (NASDAQ:AMZN) might be a better candidate to consider a long position.