Is Microsoft Corporation (NASDAQ:MSFT) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments (for some reason media paid a ton of attention to Ackman’s gigantic JC Penney and Valeant failures) and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Is Microsoft Corporation (NASDAQ:MSFT)’s case, the best stock pickers are turning less bullish. The number of bullish hedge fund positions was trimmed by five lately. At the end of this article we will also compare MSFT to other stocks including Exxon Mobil Corporation (NYSE:XOM), Berkshire Hathaway Inc. (NYSE:BRK-B), and Amazon.com, Inc. (NASDAQ:AMZN) to get a better sense of its popularity.

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

To most shareholders, hedge funds are assumed to be slow, outdated investment tools of the past. While there are over 8,000 funds trading today, Our experts look at the elite of this club, about 700 funds. It is estimated that this group of investors control bulk of all hedge funds’ total asset base, and by tracking their top picks, Insider Monkey has unsheathed a few investment strategies that have historically exceeded Mr. Market. Insider Monkey’s small-cap hedge fund strategy outrun the S&P 500 index by 12 percentage points annually for a decade in their back tests.

drserg / Shutterstock.com

Keeping this in mind, we’re going to take a look at the fresh action encompassing Microsoft Corporation (NASDAQ:MSFT).

How are hedge funds trading Microsoft Corporation (NASDAQ:MSFT)?

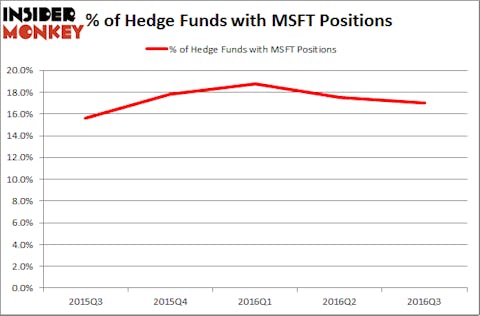

Heading into the fourth quarter of 2016, a total of 126 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 4% over the quarter. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, ValueAct Capital, managed by Jeffrey Ubben, holds the largest position in Microsoft Corporation (NASDAQ:MSFT). ValueAct Capital has a $2.22 billion position in the stock, comprising 19.4% of its 13F portfolio. The second-largest stake is held by Eagle Capital Management, led by Boykin Curry, holding a $1.64 billion position; 7.1% of its 13F portfolio is allocated to the company. Some other peers with similar optimism contain Ken Fisher’s Fisher Asset Management, David Blood and Al Gore’s Generation Investment Management and Stephen Mandel’s Lone Pine Capital.