The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Micron Technology, Inc. (NASDAQ:MU).

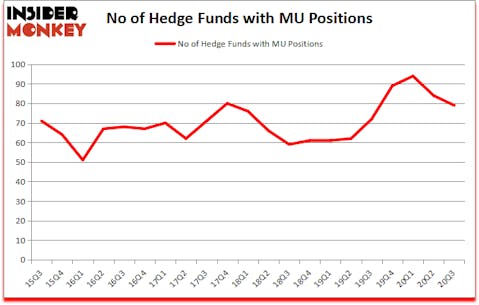

Micron Technology, Inc. (NASDAQ:MU) has seen a decrease in support from the world’s most elite money managers of late. Micron Technology, Inc. (NASDAQ:MU) was in 79 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistics is 94. Our calculations also showed that MU isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are viewed as unimportant, outdated financial tools of yesteryear. While there are more than 8000 funds in operation at the moment, Our researchers hone in on the aristocrats of this club, approximately 850 funds. Most estimates calculate that this group of people manage the lion’s share of the smart money’s total asset base, and by following their unrivaled equity investments, Insider Monkey has spotted a number of investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

David Tepper of Appaloosa Management LP

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s take a look at the recent hedge fund action encompassing Micron Technology, Inc. (NASDAQ:MU).

Hedge fund activity in Micron Technology, Inc. (NASDAQ:MU)

At Q3’s end, a total of 79 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MU over the last 21 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Arrowstreet Capital was the largest shareholder of Micron Technology, Inc. (NASDAQ:MU), with a stake worth $846.5 million reported as of the end of September. Trailing Arrowstreet Capital was Appaloosa Management LP, which amassed a stake valued at $575.3 million. Citadel Investment Group, Matrix Capital Management, and Baupost Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Mohnish Pabrai allocated the biggest weight to Micron Technology, Inc. (NASDAQ:MU), around 57.32% of its 13F portfolio. Appaloosa Management LP is also relatively very bullish on the stock, setting aside 10.17 percent of its 13F equity portfolio to MU.

Because Micron Technology, Inc. (NASDAQ:MU) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there is a sect of fund managers that elected to cut their positions entirely heading into Q4. Intriguingly, Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management sold off the largest investment of the 750 funds followed by Insider Monkey, totaling close to $124.7 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also sold off its stock, about $34.6 million worth. These transactions are interesting, as total hedge fund interest dropped by 5 funds heading into Q4.

Let’s now take a look at hedge fund activity in other stocks similar to Micron Technology, Inc. (NASDAQ:MU). These stocks are Truist Financial Corporation (NYSE:TFC), Workday Inc (NASDAQ:WDAY), Newmont Corporation (NYSE:NEM), Autodesk, Inc. (NASDAQ:ADSK), Dell Technologies Inc. (NYSE:DELL), Kimberly Clark Corporation (NYSE:KMB), and The Bank of Nova Scotia (NYSE:BNS). This group of stocks’ market caps match MU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TFC | 29 | 180947 | -4 |

| WDAY | 74 | 4396870 | 1 |

| NEM | 55 | 1951831 | 0 |

| ADSK | 65 | 3169801 | -2 |

| DELL | 43 | 3763509 | -7 |

| KMB | 41 | 1510301 | 4 |

| BNS | 14 | 175517 | 1 |

| Average | 45.9 | 2164111 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 45.9 hedge funds with bullish positions and the average amount invested in these stocks was $2164 million. That figure was $4571 million in MU’s case. Workday Inc (NASDAQ:WDAY) is the most popular stock in this table. On the other hand The Bank of Nova Scotia (NYSE:BNS) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Micron Technology, Inc. (NASDAQ:MU) is more popular among hedge funds. Our overall hedge fund sentiment score for MU is 75.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 30.7% in 2020 through November 27th but still managed to beat the market by 16.1 percentage points. Hedge funds were also right about betting on MU as the stock returned 36.8% since the end of September (through 11/27) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Micron Technology Inc (NASDAQ:MU)

Follow Micron Technology Inc (NASDAQ:MU)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.