Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 12.1% in 2019 (through May 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 18.7% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like MFA Financial, Inc. (NYSE:MFA).

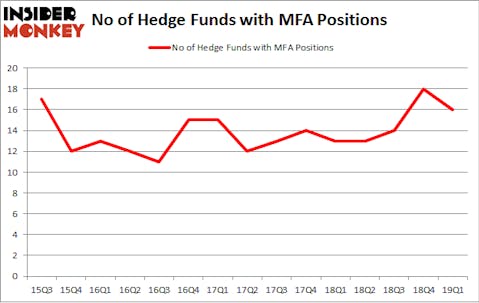

MFA Financial, Inc. (NYSE:MFA) was in 16 hedge funds’ portfolios at the end of March. MFA investors should pay attention to a decrease in hedge fund interest recently. There were 18 hedge funds in our database with MFA positions at the end of the previous quarter. Our calculations also showed that mfa isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the recent hedge fund action surrounding MFA Financial, Inc. (NYSE:MFA).

Hedge fund activity in MFA Financial, Inc. (NYSE:MFA)

At the end of the first quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from the fourth quarter of 2018. On the other hand, there were a total of 13 hedge funds with a bullish position in MFA a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the largest position in MFA Financial, Inc. (NYSE:MFA), worth close to $54.3 million, amounting to less than 0.1%% of its total 13F portfolio. On Citadel Investment Group’s heels is Jim Simons of Renaissance Technologies, with a $38.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish contain John Overdeck and David Siegel’s Two Sigma Advisors, Israel Englander’s Millennium Management and D. E. Shaw’s D E Shaw.

Since MFA Financial, Inc. (NYSE:MFA) has faced falling interest from the smart money, we can see that there were a few fund managers that slashed their positions entirely in the third quarter. Intriguingly, Mike Vranos’s Ellington said goodbye to the largest investment of the 700 funds followed by Insider Monkey, valued at an estimated $4.2 million in stock, and David Costen Haley’s HBK Investments was right behind this move, as the fund cut about $0.2 million worth. These transactions are important to note, as total hedge fund interest dropped by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as MFA Financial, Inc. (NYSE:MFA) but similarly valued. We will take a look at Silgan Holdings Inc. (NASDAQ:SLGN), iRobot Corporation (NASDAQ:IRBT), Bank of Hawaii Corporation (NYSE:BOH), and Lions Gate Entertainment Corporation (NYSE:LGF-A). This group of stocks’ market values match MFA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLGN | 15 | 156867 | 1 |

| IRBT | 15 | 121719 | 1 |

| BOH | 12 | 126229 | -1 |

| LGF-A | 18 | 315578 | -3 |

| Average | 15 | 180098 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $180 million. That figure was $130 million in MFA’s case. Lions Gate Entertainment Corporation (NYSE:LGF-A) is the most popular stock in this table. On the other hand Bank of Hawaii Corporation (NYSE:BOH) is the least popular one with only 12 bullish hedge fund positions. MFA Financial, Inc. (NYSE:MFA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately MFA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MFA were disappointed as the stock returned -0.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.