Does Merus N.V. (NASDAQ:MRUS) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

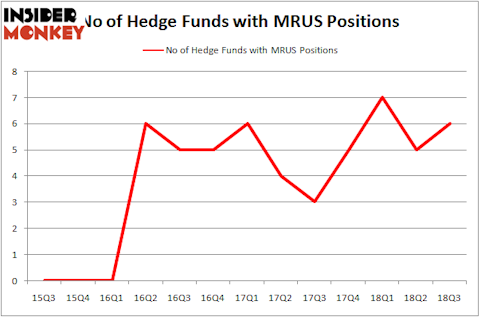

Merus N.V. (NASDAQ:MRUS) investors should pay attention to an increase in hedge fund interest of late. Our calculations also showed that MRUS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action encompassing Merus N.V. (NASDAQ:MRUS).

What does the smart money think about Merus N.V. (NASDAQ:MRUS)?

Heading into the fourth quarter of 2018, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MRUS over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Merus N.V. (NASDAQ:MRUS) was held by Biotechnology Value Fund / BVF Inc, which reported holding $77.3 million worth of stock at the end of September. It was followed by Baker Bros. Advisors with a $22.9 million position. Other investors bullish on the company included Laurion Capital Management, Platinum Asset Management, and Renaissance Technologies.

Consequently, key money managers have been driving this bullishness. Laurion Capital Management, managed by Benjamin A. Smith, created the most outsized position in Merus N.V. (NASDAQ:MRUS). Laurion Capital Management had $2.1 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also made a $0 million investment in the stock during the quarter.

Let’s also examine hedge fund activity in other stocks similar to Merus N.V. (NASDAQ:MRUS). These stocks are New Gold Inc. (NYSEAMEX:NGD), Dermira Inc (NASDAQ:DERM), Blackrock MuniYield New York Quality Fund, Inc. (NYSE:MYN), and City Office REIT Inc (NYSE:CIO). This group of stocks’ market caps are closest to MRUS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NGD | 14 | 47687 | 0 |

| DERM | 17 | 88394 | 0 |

| MYN | 2 | 2216 | -1 |

| CIO | 6 | 28732 | -1 |

| Average | 9.75 | 41757 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $105 million in MRUS’s case. Dermira Inc (NASDAQ:DERM) is the most popular stock in this table. On the other hand Blackrock MuniYield New York Quality Fund, Inc. (NYSE:MYN) is the least popular one with only 2 bullish hedge fund positions. Merus N.V. (NASDAQ:MRUS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DERM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.