At Insider Monkey, we track over 700 of the most successful hedge funds in the world and analyze their top stock picks so as to gain insight into their collective buying habits. Despite redemptions totaling about $67 billion this year, hedge funds’ assets under management have risen to $3.24 trillion thanks to gains of 5.44% this year. While hedge funds continue to underperform the market, we have found that they excel at picking stocks on the long side of their portfolios, while generally not faring as well with their other investments, which drags down their overall returns. For example, their top-30 mid-cap stock picks delivered 18% returns during the 12-month period ended November 21, 2016, while the S&P 500 Index posted gains of less than half that (7.6%). This is why we share the top picks and trends among the group of hedge funds that we follow with readers, and why in this article, we’ll see how they’ve recently traded Merck & Co., Inc. (NYSE:MRK).

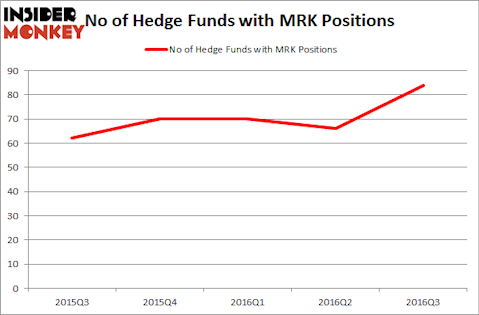

MRK was in 84 hedge funds’ portfolios at the end of September. MRK has experienced a notable increase in support from the world’s most elite money managers lately. There were 66 hedge funds in our database with MRK positions at the end of the previous quarter. At the end of this article we will also compare MRK to other stocks including The Home Depot, Inc. (NYSE:HD), The Walt Disney Company (NYSE:DIS), and Comcast Corporation (NASDAQ:CMCSA) to get a better sense of its popularity.

Follow Merck & Co. Inc. (NYSE:MRK)

Follow Merck & Co. Inc. (NYSE:MRK)

Receive real-time insider trading and news alerts

To the average investor there are a lot of gauges market participants use to evaluate their holdings. Two of the most useful gauges are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best money managers can beat the broader indices by a significant amount (see the details).

Copyright: kadmy / 123RF Stock Photo

With all of this in mind, we’re going to take a look at the recent action encompassing Merck & Co., Inc. (NYSE:MRK).

What have hedge funds been doing with Merck & Co., Inc. (NYSE:MRK)?

At the end of the third quarter, a total of 84 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 27% jump from one quarter earlier. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ken Fisher’s Fisher Asset Management has the largest position in Merck & Co., Inc. (NYSE:MRK), worth close to $425.5 million, comprising 0.8% of its total 13F portfolio. The second largest stake is held by Israel Englander of Millennium Management, with a $339.5 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish contain Phill Gross and Robert Atchinson’s Adage Capital Management, Cliff Asness’ AQR Capital Management, and Samuel Isaly’s OrbiMed Advisors.

Now, some big names have jumped into Merck & Co., Inc. (NYSE:MRK) headfirst. Citadel Investment Group, managed by Ken Griffin, initiated the most valuable position in Merck & Co., Inc. (NYSE:MRK). Citadel Investment Group had $200.7 million invested in the company at the end of the quarter. Zach Schreiber’s Point State Capital also made a $172.7 million investment in the stock during the quarter. The other funds with brand new MRK positions include Bain Capital’s Brookside Capital, James Dondero’s Highland Capital Management, and Aaron Cowen’s Suvretta Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Merck & Co., Inc. (NYSE:MRK) but similarly valued. These stocks are The Home Depot, Inc. (NYSE:HD), The Walt Disney Company (NYSE:DIS), Comcast Corporation (NASDAQ:CMCSA), and Philip Morris International Inc. (NYSE:PM). This group of stocks’ market values resemble MRK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HD | 72 | 4308946 | 5 |

| DIS | 51 | 3800907 | 7 |

| CMCSA | 83 | 8162514 | -5 |

| PM | 45 | 4516843 | -2 |

As you can see these stocks had an average of 62.75 hedge funds with bullish positions and the average amount invested in these stocks was $5.20 billion. That figure was $3.85 billion in MRK’s case. Comcast Corporation (NASDAQ:CMCSA) is the most popular stock in this table. On the other hand Philip Morris International Inc. (NYSE:PM) is the least popular one with only 45 bullish hedge fund positions. Compared to these stocks Merck & Co., Inc. (NYSE:MRK) is more popular among hedge funds, though Comcast has far more money invested in it. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None