Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space. Nevertheless, it is also possible to identify cheap large cap stocks by following the footsteps of best performing hedge funds.

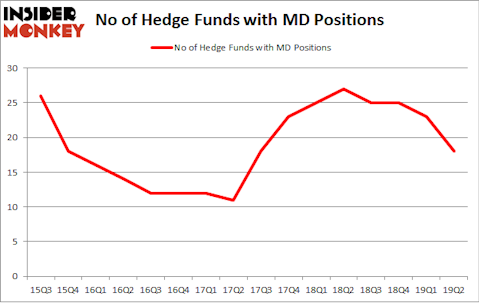

Mednax Inc. (NYSE:MD) investors should pay attention to a decrease in activity from the world’s largest hedge funds of late. MD was in 18 hedge funds’ portfolios at the end of June. There were 23 hedge funds in our database with MD holdings at the end of the previous quarter. Our calculations also showed that MD isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a glance at the recent hedge fund action regarding Mednax Inc. (NYSE:MD).

How are hedge funds trading Mednax Inc. (NYSE:MD)?

At the end of the second quarter, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -22% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MD over the last 16 quarters. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, D E Shaw held the most valuable stake in Mednax Inc. (NYSE:MD), which was worth $75.7 million at the end of the second quarter. On the second spot was P2 Capital Partners which amassed $69.4 million worth of shares. Moreover, AQR Capital Management, Winton Capital Management, and Renaissance Technologies were also bullish on Mednax Inc. (NYSE:MD), allocating a large percentage of their portfolios to this stock.

Because Mednax Inc. (NYSE:MD) has witnessed falling interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of hedgies that elected to cut their positions entirely heading into Q3. It’s worth mentioning that Richard S. Pzena’s Pzena Investment Management dropped the biggest stake of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $62.2 million in stock, and Clifton S. Robbins’s Blue Harbour Group was right behind this move, as the fund dropped about $37.6 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 5 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Mednax Inc. (NYSE:MD) but similarly valued. We will take a look at BEST Inc. (NYSE:BEST), JELD-WEN Holding, Inc. (NYSE:JELD), Artisan Partners Asset Management Inc (NYSE:APAM), and Trustmark Corporation (NASDAQ:TRMK). This group of stocks’ market valuations are closest to MD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BEST | 13 | 49071 | -3 |

| JELD | 16 | 366014 | -5 |

| APAM | 15 | 202840 | -1 |

| TRMK | 14 | 28099 | 3 |

| Average | 14.5 | 161506 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $162 million. That figure was $269 million in MD’s case. JELD-WEN Holding, Inc. (NYSE:JELD) is the most popular stock in this table. On the other hand BEST Inc. (NYSE:BEST) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Mednax Inc. (NYSE:MD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MD wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MD were disappointed as the stock returned -10.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.