Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. Trends reversed 180 degrees during the first quarter amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the first quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Magna International Inc. (NYSE:MGA).

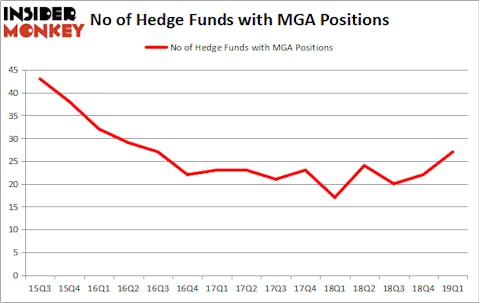

Magna International Inc. (NYSE:MGA) was in 27 hedge funds’ portfolios at the end of the first quarter of 2019. MGA has experienced an increase in enthusiasm from smart money of late. There were 22 hedge funds in our database with MGA positions at the end of the previous quarter. Our calculations also showed that MGA isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the latest hedge fund action regarding Magna International Inc. (NYSE:MGA).

How are hedge funds trading Magna International Inc. (NYSE:MGA)?

At Q1’s end, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 23% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MGA over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Magna International Inc. (NYSE:MGA), which was worth $199.5 million at the end of the first quarter. On the second spot was Arrowstreet Capital which amassed $73.8 million worth of shares. Moreover, D E Shaw, East Side Capital (RR Partners), and Millennium Management were also bullish on Magna International Inc. (NYSE:MGA), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the most outsized position in Magna International Inc. (NYSE:MGA). Arrowstreet Capital had $73.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $32.9 million investment in the stock during the quarter. The following funds were also among the new MGA investors: Jim Simons’s Renaissance Technologies, Minhua Zhang’s Weld Capital Management, and Mike Vranos’s Ellington.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Magna International Inc. (NYSE:MGA) but similarly valued. We will take a look at Match Group, Inc. (NASDAQ:MTCH), CMS Energy Corporation (NYSE:CMS), Vulcan Materials Company (NYSE:VMC), and Avangrid, Inc. (NYSE:AGR). This group of stocks’ market values are closest to MGA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTCH | 24 | 573647 | 0 |

| CMS | 22 | 488168 | 1 |

| VMC | 48 | 1767755 | 7 |

| AGR | 17 | 390906 | 4 |

| Average | 27.75 | 805119 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.75 hedge funds with bullish positions and the average amount invested in these stocks was $805 million. That figure was $524 million in MGA’s case. Vulcan Materials Company (NYSE:VMC) is the most popular stock in this table. On the other hand Avangrid, Inc. (NYSE:AGR) is the least popular one with only 17 bullish hedge fund positions. Magna International Inc. (NYSE:MGA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MGA wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); MGA investors were disappointed as the stock returned -9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.