Does MAG Silver Corp. (NYSE:MAG) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

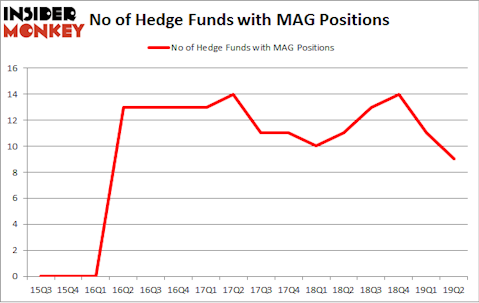

Is MAG Silver Corp. (NYSE:MAG) a cheap investment today? Investors who are in the know are in a pessimistic mood. The number of bullish hedge fund bets fell by 2 in recent months. Our calculations also showed that MAG isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous indicators stock traders use to appraise publicly traded companies. A couple of the less known indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite investment managers can trounce the broader indices by a solid margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the key hedge fund action encompassing MAG Silver Corp. (NYSE:MAG).

What does smart money think about MAG Silver Corp. (NYSE:MAG)?

Heading into the third quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -18% from the first quarter of 2019. By comparison, 11 hedge funds held shares or bullish call options in MAG a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

The largest stake in MAG Silver Corp. (NYSE:MAG) was held by Sprott Asset Management, which reported holding $13.8 million worth of stock at the end of March. It was followed by Royce & Associates with a $3.7 million position. Other investors bullish on the company included D E Shaw, GRT Capital Partners, and Vertex One Asset Management.

Since MAG Silver Corp. (NYSE:MAG) has faced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of funds that elected to cut their entire stakes heading into Q3. Interestingly, Peter Franklin Palmedo’s Sun Valley Gold dumped the biggest stake of the 750 funds tracked by Insider Monkey, valued at close to $5.9 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $0.2 million worth. These moves are interesting, as total hedge fund interest fell by 2 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as MAG Silver Corp. (NYSE:MAG) but similarly valued. These stocks are Interface, Inc. (NASDAQ:TILE), CTS Corporation (NYSE:CTS), General American Investors Company, Inc. (NYSE:GAM), and CIRCOR International, Inc. (NYSE:CIR). This group of stocks’ market values resemble MAG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TILE | 12 | 36187 | -2 |

| CTS | 9 | 80933 | -1 |

| GAM | 5 | 128273 | 0 |

| CIR | 10 | 175397 | 3 |

| Average | 9 | 105198 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $105 million. That figure was $25 million in MAG’s case. Interface, Inc. (NASDAQ:TILE) is the most popular stock in this table. On the other hand General American Investors Company, Inc. (NYSE:GAM) is the least popular one with only 5 bullish hedge fund positions. MAG Silver Corp. (NYSE:MAG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MAG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); MAG investors were disappointed as the stock returned 0.7% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.