Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

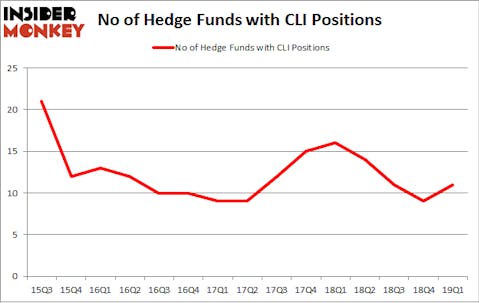

Is Mack-Cali Realty Corporation (NYSE:CLI) the right investment to pursue these days? Hedge funds are getting more optimistic. The number of bullish hedge fund positions increased by 2 lately. Our calculations also showed that cli isn’t among the 30 most popular stocks among hedge funds. CLI was in 11 hedge funds’ portfolios at the end of the first quarter of 2019. There were 9 hedge funds in our database with CLI holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a gander at the fresh hedge fund action surrounding Mack-Cali Realty Corporation (NYSE:CLI).

How have hedgies been trading Mack-Cali Realty Corporation (NYSE:CLI)?

Heading into the second quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in CLI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Mack-Cali Realty Corporation (NYSE:CLI), which was worth $105.7 million at the end of the first quarter. On the second spot was Long Pond Capital which amassed $10 million worth of shares. Moreover, Fisher Asset Management, Springbok Capital, and Citadel Investment Group were also bullish on Mack-Cali Realty Corporation (NYSE:CLI), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names have jumped into Mack-Cali Realty Corporation (NYSE:CLI) headfirst. Long Pond Capital, managed by John Khoury, established the largest position in Mack-Cali Realty Corporation (NYSE:CLI). Long Pond Capital had $10 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also made a $1 million investment in the stock during the quarter. The other funds with brand new CLI positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Mike Vranos’s Ellington, and John A. Levin’s Levin Capital Strategies.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Mack-Cali Realty Corporation (NYSE:CLI) but similarly valued. These stocks are Progress Software Corporation (NASDAQ:PRGS), Altra Industrial Motion Corp. (NASDAQ:AIMC), Veoneer, Inc. (NYSE:VNE), and Luxoft Holding Inc (NYSE:LXFT). This group of stocks’ market caps match CLI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRGS | 24 | 257769 | 2 |

| AIMC | 22 | 309252 | 1 |

| VNE | 8 | 160838 | -2 |

| LXFT | 23 | 389871 | 9 |

| Average | 19.25 | 279433 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $279 million. That figure was $133 million in CLI’s case. Progress Software Corporation (NASDAQ:PRGS) is the most popular stock in this table. On the other hand Veoneer, Inc. (NYSE:VNE) is the least popular one with only 8 bullish hedge fund positions. Mack-Cali Realty Corporation (NYSE:CLI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on CLI as the stock returned 9.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.