A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of M/A-COM Technology Solutions Holdings (NASDAQ:MTSI) during the quarter.

M/A-COM Technology Solutions Holdings (NASDAQ:MTSI) has seen an increase in enthusiasm from smart money recently. Our calculations also showed that MTSI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the key hedge fund action surrounding M/A-COM Technology Solutions Holdings (NASDAQ:MTSI).

What have hedge funds been doing with M/A-COM Technology Solutions Holdings (NASDAQ:MTSI)?

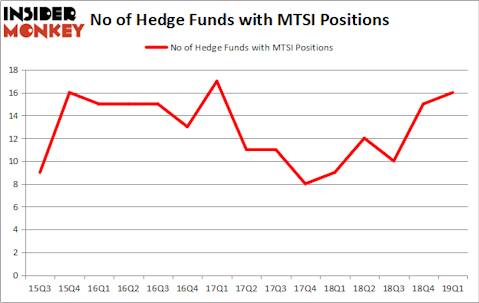

At the end of the first quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MTSI over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jonathan Guo’s Yiheng Capital has the largest position in M/A-COM Technology Solutions Holdings (NASDAQ:MTSI), worth close to $50.7 million, corresponding to 5.9% of its total 13F portfolio. Sitting at the No. 2 spot is D E Shaw, managed by D. E. Shaw, which holds a $25.8 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism contain Joe Milano’s Greenhouse Funds, Chuck Royce’s Royce & Associates and Mariko Gordon’s Daruma Asset Management.

Consequently, key money managers were leading the bulls’ herd. Tudor Investment Corp, managed by Paul Tudor Jones, assembled the most outsized position in M/A-COM Technology Solutions Holdings (NASDAQ:MTSI). Tudor Investment Corp had $0.5 million invested in the company at the end of the quarter. Cliff Asness’s AQR Capital Management also made a $0.4 million investment in the stock during the quarter. The only other fund with a brand new MTSI position is Frank Slattery’s Symmetry Peak Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as M/A-COM Technology Solutions Holdings (NASDAQ:MTSI) but similarly valued. These stocks are Canadian Solar Inc. (NASDAQ:CSIQ), New Mountain Finance Corp. (NYSE:NMFC), Pacific Biosciences of California (NASDAQ:PACB), and Garrett Motion Inc. (NYSE:GTX). This group of stocks’ market valuations are similar to MTSI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSIQ | 11 | 122280 | 0 |

| NMFC | 9 | 26087 | -2 |

| PACB | 19 | 241025 | -2 |

| GTX | 19 | 262120 | 6 |

| Average | 14.5 | 162878 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $163 million. That figure was $134 million in MTSI’s case. Pacific Biosciences of California (NASDAQ:PACB) is the most popular stock in this table. On the other hand New Mountain Finance Corp. (NYSE:NMFC) is the least popular one with only 9 bullish hedge fund positions. M/A-COM Technology Solutions Holdings (NASDAQ:MTSI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately MTSI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MTSI were disappointed as the stock returned -16.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.