Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 9 months of this year through September 30th the Standard and Poor’s 500 Index returned approximately 20% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 24% during the same 9-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like M.D.C. Holdings, Inc. (NYSE:MDC).

Hedge fund interest in M.D.C. Holdings, Inc. (NYSE:MDC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Avanos Medical, Inc. (NYSE:AVNS), Wageworks Inc (NYSE:WAGE), and Conduent Incorporated (NYSE:CNDT) to gather more data points. Our calculations also showed that MDC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are numerous signals stock traders put to use to evaluate publicly traded companies. A pair of the less utilized signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite fund managers can outpace the S&P 500 by a superb margin (see the details here).

Steve Leonard of Pacifica Capital

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the latest hedge fund action regarding M.D.C. Holdings, Inc. (NYSE:MDC).

How are hedge funds trading M.D.C. Holdings, Inc. (NYSE:MDC)?

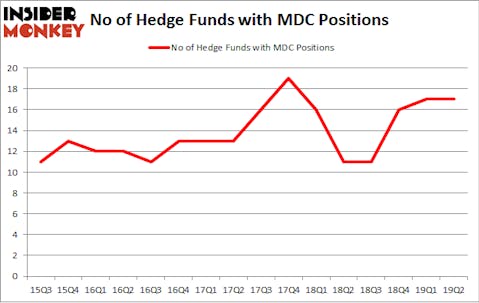

At the end of the second quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards MDC over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Polar Capital was the largest shareholder of M.D.C. Holdings, Inc. (NYSE:MDC), with a stake worth $21.5 million reported as of the end of March. Trailing Polar Capital was Royce & Associates, which amassed a stake valued at $16.1 million. Pacifica Capital Investments, Balyasny Asset Management, and Fisher Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that M.D.C. Holdings, Inc. (NYSE:MDC) has faced falling interest from hedge fund managers, it’s safe to say that there exists a select few hedge funds that elected to cut their positions entirely by the end of the second quarter. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dropped the largest position of all the hedgies monitored by Insider Monkey, valued at close to $2.5 million in stock. D. E. Shaw’s fund, D E Shaw, also dropped its stock, about $1.1 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to M.D.C. Holdings, Inc. (NYSE:MDC). We will take a look at Avanos Medical, Inc. (NYSE:AVNS), Wageworks Inc (NYSE:WAGE), Conduent Incorporated (NYSE:CNDT), and Meritage Homes Corporation (NYSE:MTH). This group of stocks’ market valuations resemble MDC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVNS | 11 | 83258 | 0 |

| WAGE | 21 | 254378 | 0 |

| CNDT | 27 | 591464 | -3 |

| MTH | 15 | 191125 | 1 |

| Average | 18.5 | 280056 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $280 million. That figure was $82 million in MDC’s case. Conduent Incorporated (NYSE:CNDT) is the most popular stock in this table. On the other hand Avanos Medical, Inc. (NYSE:AVNS) is the least popular one with only 11 bullish hedge fund positions. M.D.C. Holdings, Inc. (NYSE:MDC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on MDC as the stock returned 32.6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.