Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Lumentum Holdings Inc (NASDAQ:LITE).

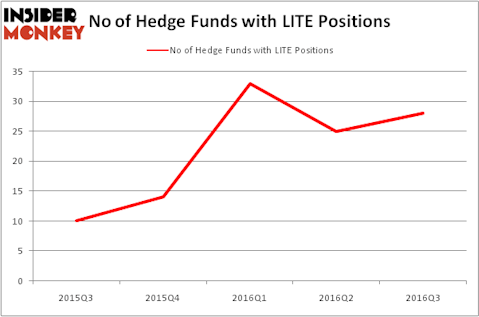

Is Lumentum Holdings Inc (NASDAQ:LITE) a healthy stock for your portfolio? Investors who are in the know are surely betting on the stock. The number of long hedge fund investments grew by 3 lately. LITE was in 28 hedge funds’ portfolios at the end of September. There were 25 hedge funds in our database with LITE holdings at the end of the previous quarter. At the end of this article we will also compare LITE to other stocks including Lexmark International Inc (NYSE:LXK), Fulton Financial Corp (NASDAQ:FULT), and Versum Materials Inc (NYSE:VSM) to get a better sense of its popularity.

Follow Lumentum Holdings Inc. (NASDAQ:LITE)

Follow Lumentum Holdings Inc. (NASDAQ:LITE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Maxx-Studio/Shutterstock.com

What does the smart money think about Lumentum Holdings Inc (NASDAQ:LITE)?

Heading into the fourth quarter of 2016, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 12% from one quarter earlier. By comparison, 14 hedge funds held shares or bullish call options in LITE heading into this year. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, John Overdeck and David Siegel’s Two Sigma Advisors has the number one position in Lumentum Holdings Inc (NASDAQ:LITE), worth close to $22.4 million. The second most bullish fund manager is Kingdon Capital, led by Mark Kingdon, holding a $15.4 million position. Remaining professional money managers that hold long positions include Richard Driehaus’ Driehaus Capital, Clint Carlson’s Carlson Capital and Ken Hahn’s Quentec Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.