Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th. What do these smart investors think about Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA)?

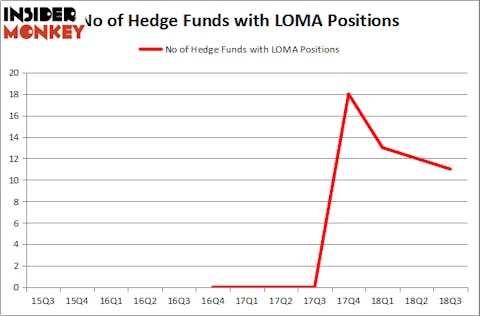

Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA) shareholders have witnessed a decrease in enthusiasm from smart money recently. Our calculations also showed that LOMA isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s review the latest hedge fund action regarding Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA).

Hedge fund activity in Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA)

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in LOMA heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, David Halpert’s Prince Street Capital Management has the largest position in Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA), worth close to $4.8 million, amounting to 1% of its total 13F portfolio. The second most bullish fund manager is Balyasny Asset Management, led by Dmitry Balyasny, holding a $4.7 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism encompass Edmond M. Safra’s EMS Capital, James Dondero’s Highland Capital Management and David Costen Haley’s HBK Investments.

Because Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA) has faced falling interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few money managers who were dropping their full holdings heading into Q3. It’s worth mentioning that Zach Schreiber’s Point State Capital dumped the largest stake of the “upper crust” of funds tracked by Insider Monkey, totaling about $25.1 million in stock, and Jos Shaver’s Electron Capital Partners was right behind this move, as the fund said goodbye to about $6.4 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA). These stocks are SSR Mining Inc. (NASDAQ:SSRM), Summit Midstream Partners LP (NYSE:SMLP), Sunlands Online Education Group (NYSE:STG), and TCG BDC, Inc. (NASDAQ:CGBD). This group of stocks’ market values match LOMA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSRM | 8 | 87909 | 0 |

| SMLP | 3 | 62118 | 0 |

| STG | 5 | 2588 | -1 |

| CGBD | 4 | 4302 | -3 |

| Average | 5 | 39229 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $20 million in LOMA’s case. SSR Mining Inc. (NASDAQ:SSRM) is the most popular stock in this table. On the other hand Summit Midstream Partners LP (NYSE:SMLP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.