Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

In this article, we are going to take a closer look at the hedge fund sentiment towards LivaNova PLC (NASDAQ:LIVN). Overall, the stock registered a decline in popularity among the investors in our database during the third quarter and 16 funds held shares of the company at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Associated Banc Corp (NYSE:ASB), Valero Energy Partners LP (NYSE:VLP), and Exelixis, Inc. (NASDAQ:EXEL) to gather more data points.

Follow Livanova Plc (NASDAQ:LIVN)

Follow Livanova Plc (NASDAQ:LIVN)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

everything possible/Shutterstock.com

With all of this in mind, let’s take a peek at the key action encompassing LivaNova PLC (NASDAQ:LIVN).

What does the smart money think about LivaNova PLC (NASDAQ:LIVN)?

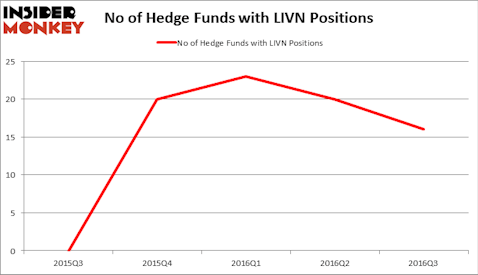

At the end of the third quarter, 16 funds tracked by Insider Monkey were long this stock, down from 20 funds at the end of June. The graph below displays the number of hedge funds with bullish position in LIVN over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the largest position in LivaNova PLC (NASDAQ:LIVN). Renaissance Technologies has a $125.9 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund is Stuart Powers’ Hengistbury Investment Partners, which holds a $108.9 million position; 18.5% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors with similar optimism encompass Stephen DuBois’ Camber Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Martin Whitman’s Third Avenue Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.