We recently compiled a list of the 8 Best Electronic Stocks To Buy According to Hedge Funds. In this article, we are going to take a look at where Littelfuse Inc. (NASDAQ:LFUS) stands against the other electronic stocks.

The Electronics Industry’s Growth Trajectory

The electronics sector is experiencing robust growth driven by several key factors. Technological advancements, particularly in consumer electronics, are a major catalyst, with innovations in smartphones, the emergence of 3G and 4G technologies, smart wearables, and smart home devices significantly boosting demand. According to Grand View Research, the global consumer electronics market is projected to experience significant growth, expanding from $1,068.22 billion in 2022 to $1,619.04 billion by 2030, with a compound annual growth rate of 6.6%.

Additionally, rising income levels, especially in emerging markets, are fueling demand, as more households can afford electronic devices. The expansion of the IoT ecosystem presents new opportunities within the sector, enhancing automation and efficiency across various applications. Advancements in semiconductor technology are crucial for this growth, powering everything from smartphones to electric vehicles. Furthermore, sustainability initiatives are becoming increasingly important, with companies exploring eco-friendly manufacturing practices and materials to meet consumer demand for greener products.

The semiconductor industry is at a pivotal moment, driven by rapid advancements in AI and the evolving dynamics of the market. With significant players recently reporting disappointing earnings and a slower-than-expected recovery in chip demand, the sentiment surrounding semiconductor stocks is one of cautious optimism. As the market grapples with these challenges, investors are keenly focused on identifying the best electronic stocks poised to thrive amid this transformative landscape.

On October 16, Dan Niles, Niles Investment Management founder & portfolio manager, joined ‘Fast Money’ on CNBC to discuss how semiconductors are a canary in the coal mine for the tech sector. In a recent discussion about the semiconductor sector and mega-cap technology, Dan Niles provided insights into ASML’s recent performance and its implications for the broader chip industry. He highlighted that the Dutch company experienced a significant miss in orders, reporting over a 50% decline compared to expectations. This drop indicates that while demand for certain products remains strong, the overall outlook for the semiconductor market is weaker than anticipated. Niles explained that if companies are ordering its equipment today, it typically means they are preparing to produce chips about a year from now. This lag suggests a slowdown in demand that could impact future revenues.

The relationship between electronic stocks and the semiconductor industry is vital and mutually reinforcing, as semiconductors serve as the backbone of modern electronic devices. The performance of semiconductor stocks directly impacts the broader electronics sector. Supply chain fluctuations can significantly affect both industries; shortages may lead to production delays and reduced revenues for electronic manufacturers, while stabilization can foster growth for both sectors.

Our Methodology

We sifted through ETFs, online rankings, and internet lists to compile a list of 15 electronic stocks with high market caps. We then selected the 8 stocks that were the most popular among elite hedge funds and that analysts were bullish on. The stocks are ranked in ascending order of the number of hedge funds that have stakes in them, as of Q2 2024. The hedge fund data was sourced from Insider Monkey’s database which tracks the moves of over 900 elite money managers.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

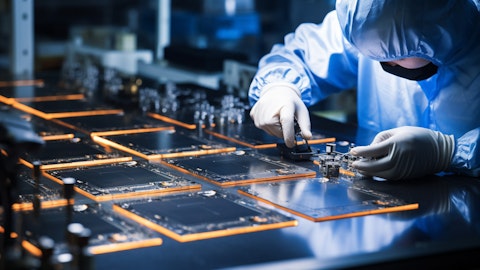

An experienced electronic technician soldering a PCB circuit board.

Littelfuse Inc. (NASDAQ:LFUS)

Market Cap as of October 22: $6.28 billion

Number of Hedge Fund Holders: 30

Littelfuse Inc. (NASDAQ:LFUS) is an American electronics manufacturer that primarily produces circuit protection products (fuses) and a variety of switches and automotive sensors. These components are crucial in safeguarding electrical circuits and devices from damage caused by overloads or short circuits, serving industries such as automotive, consumer electronics, and industrial applications.

It has secured significant new business in both transportation and industrial markets. In transportation, the company has won contracts for high-voltage fuses, low-voltage fuses, battery management systems, and switch technology. In industrial markets, it has secured design wins in HVAC, industrial safety, renewables, and EV charging.

The Q2 financial results for the electronics market were mixed. Demand for consumer products, appliances, and building technologies remains soft, but customers are optimistic about AI-driven growth. Datacenter applications, especially AI-driven ones, saw strong demand.

The company’s second-quarter 2024 revenue dropped 8.74% year-over-year, still recording an amount of $558.49 million. This decline was primarily driven by product line pruning actions and unfavorable foreign exchange movements. The Electronics Products segment experienced the most significant drop, with sales falling 13%. The Transportation Products segment saw a more modest decline of 2%, while the Industrial Products segment decreased by 7%. Despite the headwinds, it continued to generate strong cash flow.

Looking ahead, the company expects continued challenges in the semiconductor market and some persistent commodity headwinds. However, Littelfuse Inc. (NASDAQ:LFUS) remains confident in its positioning and ability to drive value creation for its stakeholders.

Aristotle Small Cap Equity Strategy stated the following regarding Littelfuse, Inc. (NASDAQ:LFUS) in its Q2 2024 investor letter:

“Littelfuse, Inc. (NASDAQ:LFUS), a designer and manufacturer of circuit protection, power control, and sensing products for the automotive, industrial, medical, and consumer end markets, was added to the portfolio. We believe the company’s dominant position in circuit protection and growing presence in automotive sensors and power semiconductors/components should benefit from ongoing efforts to solve power control and connection problems between the digital and physical worlds.”

Overall, LFUS ranks 8th on our list of the 8 best electronic stocks to buy according to hedge funds. While we acknowledge the growth potential of LFUS, our conviction lies in the belief that AI stocks hold great promise for delivering high returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than LFUS but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.