Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by successful investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

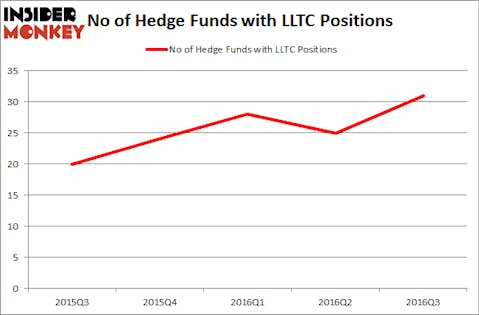

One stock that saw an increase in popularity last quarter is Linear Technology Corporation (NASDAQ:LLTC). During the third quarter, the number of funds from our database long the stock went up by six to 31. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Goldcorp Inc. (USA) (NYSE:GG), FirstEnergy Corp. (NYSE:FE), and Laboratory Corp. of America Holdings (NYSE:LH) to gather more data points.

Follow Linear Technology Corp (NASDAQ:LLTC)

Follow Linear Technology Corp (NASDAQ:LLTC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Willyam Bradberry/Shutterstock.com

Now, we’re going to view the latest action regarding Linear Technology Corporation (NASDAQ:LLTC).

How are hedge funds trading Linear Technology Corporation (NASDAQ:LLTC)?

At the end of September, a total of 31 of the hedge funds tracked by Insider Monkey were long Linear Technology Corporation (NASDAQ:LLTC), a change of 24% from the previous quarter. On the other hand, there were a total of 24 hedge funds with a bullish position in LLTC at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, David Blood and Al Gore’s Generation Investment Management holds the most valuable position in Linear Technology Corporation (NASDAQ:LLTC). Generation Investment Management has a $604.7 million position in the stock, comprising 6.5% of its 13F portfolio. Coming in second is Jim Simons’ Renaissance Technologies holding a $516.7 million position; 0.9% of its 13F portfolio is allocated to the stock. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.