Is Liberty Oilfield Services Inc. (NYSE:LBRT) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

Liberty Oilfield Services Inc. (NYSE:LBRT) investors should pay attention to a decrease in activity from the world’s largest hedge funds in recent months. Our calculations also showed that LBRT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most market participants, hedge funds are seen as unimportant, old investment tools of yesteryear. While there are greater than 8000 funds in operation today, Our experts choose to focus on the aristocrats of this group, about 750 funds. It is estimated that this group of investors oversee most of the smart money’s total capital, and by following their unrivaled stock picks, Insider Monkey has deciphered various investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the key hedge fund action regarding Liberty Oilfield Services Inc. (NYSE:LBRT).

What have hedge funds been doing with Liberty Oilfield Services Inc. (NYSE:LBRT)?

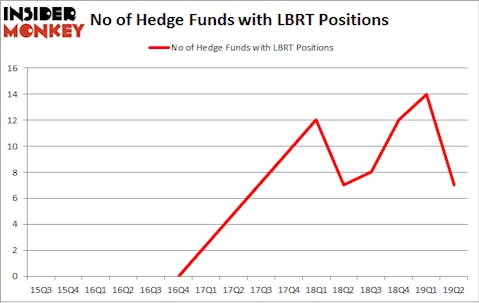

Heading into the third quarter of 2019, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of -50% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in LBRT over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Thomas E. Claugus’s GMT Capital has the largest position in Liberty Oilfield Services Inc. (NYSE:LBRT), worth close to $42.3 million, amounting to 1.5% of its total 13F portfolio. On GMT Capital’s heels is Balyasny Asset Management, led by Dmitry Balyasny, holding a $15.9 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining peers that hold long positions consist of Phill Gross and Robert Atchinson’s Adage Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Judging by the fact that Liberty Oilfield Services Inc. (NYSE:LBRT) has witnessed declining sentiment from the aggregate hedge fund industry, logic holds that there were a few money managers that slashed their entire stakes by the end of the second quarter. At the top of the heap, Israel Englander’s Millennium Management cut the biggest position of the 750 funds monitored by Insider Monkey, totaling about $15.7 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund cut about $1.8 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 7 funds by the end of the second quarter.

Let’s check out hedge fund activity in other stocks similar to Liberty Oilfield Services Inc. (NYSE:LBRT). These stocks are Global Net Lease, Inc. (NYSE:GNL), LGI Homes Inc (NASDAQ:LGIH), Oasis Petroleum Inc. (NYSE:OAS), and Moelis & Company (NYSE:MC). This group of stocks’ market caps resemble LBRT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNL | 8 | 46148 | -3 |

| LGIH | 12 | 127230 | -2 |

| OAS | 21 | 295575 | -6 |

| MC | 13 | 61723 | -10 |

| Average | 13.5 | 132669 | -5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $133 million. That figure was $68 million in LBRT’s case. Oasis Petroleum Inc. (NYSE:OAS) is the most popular stock in this table. On the other hand Global Net Lease, Inc. (NYSE:GNL) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Liberty Oilfield Services Inc. (NYSE:LBRT) is even less popular than GNL. Hedge funds dodged a bullet by taking a bearish stance towards LBRT. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately LBRT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); LBRT investors were disappointed as the stock returned -32.7% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.