The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards LGI Homes Inc (NASDAQ:LGIH), and what that likely means for the prospects of the company and its stock.

LGI Homes Inc (NASDAQ:LGIH) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Internet Initiative Japan Inc. (NASDAQ:IIJI), Hyster-Yale Materials Handling Inc (NYSE:HY), and Luxoft Holding Inc (NYSE:LXFT) to gather more data points.

In the eyes of most shareholders, hedge funds are viewed as worthless, outdated financial vehicles of the past. While there are over 8000 funds in operation today, Our researchers choose to focus on the elite of this group, approximately 750 funds. These hedge fund managers handle most of the smart money’s total capital, and by keeping an eye on their top stock picks, Insider Monkey has formulated numerous investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s check out the fresh hedge fund action regarding LGI Homes Inc (NASDAQ:LGIH).

What have hedge funds been doing with LGI Homes Inc (NASDAQ:LGIH)?

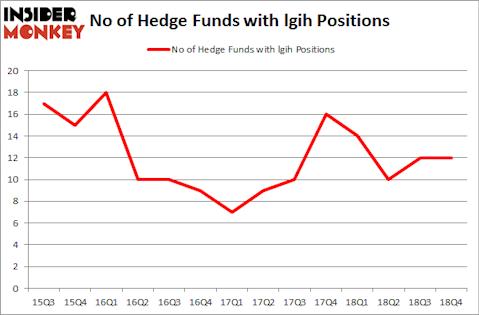

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LGIH over the last 14 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, Capital Growth Management held the most valuable stake in LGI Homes Inc (NASDAQ:LGIH), which was worth $14.5 million at the end of the fourth quarter. On the second spot was DC Capital Partners which amassed $13.6 million worth of shares. Moreover, Royce & Associates, Prescott Group Capital Management, and ZWEIG DIMENNA PARTNERS were also bullish on LGI Homes Inc (NASDAQ:LGIH), allocating a large percentage of their portfolios to this stock.

Judging by the fact that LGI Homes Inc (NASDAQ:LGIH) has faced a decline in interest from the smart money, logic holds that there is a sect of hedgies who sold off their full holdings in the third quarter. Interestingly, Parsa Kiai’s Steamboat Capital Partners dropped the biggest stake of all the hedgies followed by Insider Monkey, comprising close to $12.9 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund sold off about $4.9 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as LGI Homes Inc (NASDAQ:LGIH) but similarly valued. These stocks are Internet Initiative Japan Inc. (NASDAQ:IIJI), Hyster-Yale Materials Handling Inc (NYSE:HY), Luxoft Holding Inc (NYSE:LXFT), and Navigant Consulting, Inc. (NYSE:NCI). This group of stocks’ market valuations match LGIH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IIJI | 2 | 5123 | 0 |

| HY | 9 | 37390 | -1 |

| LXFT | 14 | 86247 | 1 |

| NCI | 17 | 68327 | 2 |

| Average | 10.5 | 49272 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $49 million. That figure was $69 million in LGIH’s case. Navigant Consulting, Inc. (NYSE:NCI) is the most popular stock in this table. On the other hand Internet Initiative Japan Inc. (NASDAQ:IIJI) is the least popular one with only 2 bullish hedge fund positions. LGI Homes Inc (NASDAQ:LGIH) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on LGIH as the stock returned 50.6% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.