A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Landec Corporation (NASDAQ:LNDC).

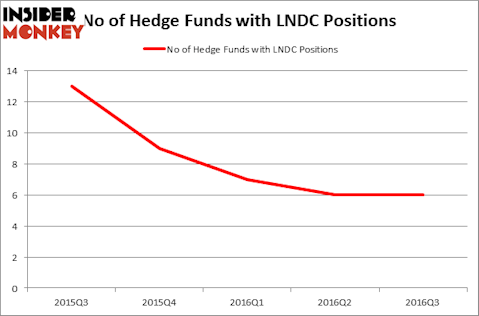

Hedge fund interest in Landec Corporation (NASDAQ:LNDC) shares was flat during the third quarter. This is usually a negative indicator. The stock was in 6 hedge funds’ portfolios on September 30, the same figure as of June 30. At the end of this article we will also compare LNDC to other stocks including Habit Restaurants Inc (NASDAQ:HABT), Johnson Outdoors Inc. (NASDAQ:JOUT), and Horizon Global Corp (NYSE:HZN) to get a better sense of its popularity.

Follow Lifecore Biomedical Inc. (NASDAQ:LFCR)

Follow Lifecore Biomedical Inc. (NASDAQ:LFCR)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

goir/Shutterstock.com

What have hedge funds been doing with Landec Corporation (NASDAQ:LNDC)?

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the previous quarter. On the other hand, there were a total of 13 hedge funds with a bullish position in LNDC a year earlier, which has since fallen by over 50%. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Wynnefield Capital, led by Nelson Obus, holds the number one position in Landec Corporation (NASDAQ:LNDC). Wynnefield Capital has a $36 million position in the stock, comprising 12% of its 13F portfolio. Coming in second is Ariel Investments, led by John W. Rogers, holding a $15.6 million position. Some other members of the smart money that are bullish encompass Chuck Royce’s Royce & Associates, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and D E Shaw , one of the biggest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.