We recently published a list of 10 Best Automation Stocks to Buy Now. In this article, we are going to take a look at where Lam Research Corporation (NASDAQ:LRCX) stands against the other automation stocks.

2023 was the year of generative AI, mainly because of the widespread adoption of ChatGPT and the resulting response that followed. Now, 2024 is the year in which companies have truly started using this ever-evolving technology. McKinsey revealed that AI supported the companies in both aspects: cost decreases and revenue jumps.

Automation Technologies- Key Trends

In 2024, the integration of automation technologies continues to revolutionize every aspect of supply chain management. This led to unprecedented levels of efficiency and agility. The global integrated automated supply chain is expected to reach US$25.6 billion by 2033, from US$13.4 billion in 2023, according to industry data by Market.us.

From removing warehousing bottlenecks to inventory management and demand forecasting, supply chain automation reshaped traditional practices and redefined the dynamics of the logistics industry. In inventory tracking, advanced warehouse management systems, which are powered by AI and ML algorithms, focus on optimizing inventory placement, route planning, resource allocation, etc.

Inventory tracking and management are being revolutionized through the usage of automation solutions, such as RFID tagging, barcode scanning, and computer vision. Real-time tracking technologies are offering granular visibility in inventory movements. This allows businesses to monitor stock levels, spot discrepancies, and manage understocking/overstocking. Manufacturers are now getting inclined towards smart factories.

Smart factories reflect and demonstrate Industry 4.0 principles. They tend to leverage 5G, IoT, AI, and other advanced technologies. Experts believe that smart factories allow predictive maintenance and decision-making.

Adoption of Advanced Automation

A new theme is emerging in the field of automation, which is automated decision-making. Its adoption rapidly expanded beyond traditional sectors such as manufacturing and logistics. Demand for decision intelligence stems from data-driven and well-informed decision-making requirements which enhances corporate competitiveness and efficiency.

Automated decision-making is now being accepted by critical domains including healthcare and finance. In healthcare, automation supplements the clinical decision-making processes, improves patient-care delivery, and manages resource allocation. It involves leveraging AI and ML algorithms to assess patient data, medical images, and genomic sequences, and customize patient care.

Likewise, in finance, automated systems continue to reshape top-notch operations like risk assessment, fraud detection, and investment management. AI algorithms assess large datasets of financial transactions and market trends to optimize investment strategies. In 2024, the software development industry is all set to embark on a remarkable transformation with cutting-edge innovations.

Quantum Computing and Robotics

The latest technologies in software that are expected to reshape the landscape include quantum computing, virtual reality (VR), augmented reality (AR), big data, data analytics, 5G technology, robotics, etc.

Quantum computing continues to rapidly advance, evolve, and reshape scientific and industrial landscapes. Unlike classical computers—which use bits as the smallest information unit—quantum computers make use of qubits. These exploit quantum mechanics principles to perform complex and difficult calculations. For example, at the time of drug discovery, quantum algorithms simulate molecular interactions in a more accurate and refined way as compared to traditional methods. The integration of quantum computing with AI is another critical emerging trend.

The unprecedented advancements in robotics and AI are expected to bring revolutionary positive transformations. More and more sectors continue to understand the benefits of adopting robotics and AI. Globally, the robotics market should achieve healthy revenue growth, with a projected value of US$38.24 billion this year. The strongest segment in the robotics market is expected to be service robotics, which should lead in market volume. Service robotics find its application in sectors, like Healthcare, Medical, Military and Defense, Logistics, etc. while industrial robots are used in Automotive, Electronics, Food & Beverage, etc.

The trends driving the robotics market are supported by developments in emerging technologies. These include 5G, AI, Edge Computing, IIoT, cloud, open-source, etc. Since AI in robotics continues to evolve, more and more industries are exploiting the latest technologies. Therefore, manufacturers are making data-driven decisions. Some industries use self-learning robots to execute work processes.

Smart factories are using AI-enabled robotics to execute smarter, reliable, and efficient processes. They help in production optimization. AI-powered robotic technologies, which include computer vision and tactile sensing, are utilized to help automate certain tasks. For example, reinforcement learning is used for better industrial assembly. The adoption of robotics, smart automation, and high-tech manufacturing will help workers with manual labor and reduce repetitive tasks.

At Insider Monkey we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

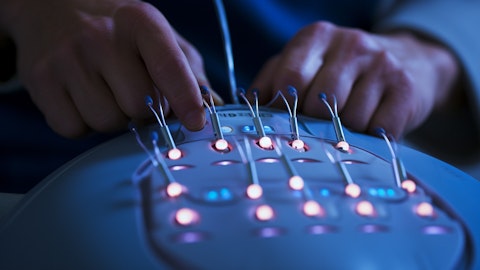

A technician operating an automated semiconductor processing machine with laser accuracy.

Lam Research Corporation (NASDAQ:LRCX)

Average Upside Potential: 29.97%

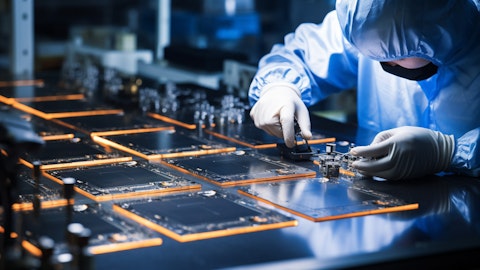

Lam Research Corporation (NASDAQ:LRCX) manufactures, markets, and services semiconductor processing equipment that is used in making integrated circuits. The company’s technology provides dynamic opportunities for businesses to push boundaries of robotics and nanotechnology.

To meet the need for cutting-edge solutions, Lam Research India joined hands with Nikit Engineers, which is a renowned provider of welding automation and robotic solutions in India. The focus of this collaboration is to implement Nikit Engineer’s Orbital Welder, which is a state-of-the-art robotic welding system, to enhance the efficiency of the connector tube welding process.

While the company’s stock was recently hammered, Wall Street analysts believe that this pullback should be considered a buying opportunity as the stock is ready to take off. Lam Research Corporation (NASDAQ:LRCX) released 4Q 2024 revenue of $3.87 billion, beating the analysts’ expectations of $3.82 billion. While its revenues went up by 21% YoY, the company’s non-GAAP earnings per share came in at $8.14. Analysts were expecting $7.58 per share.

The company is expected to benefit from an increase in memory consumption due to the growing adoption of artificial intelligence (Al). Lam Research Corporation (NASDAQ:LRCX) acknowledged seeing an additional demand due to an improvement in high-bandwidth memory (HBM) capacity investments. As per the current trend, data centers are increasingly using HBM to address Al workloads. This is because it can assess and execute enormous amounts of data. All this happens by maintaining low power consumption.

The management of Lam Research Corporation (NASDAQ:LRCX) reaffirmed a strong mid-$90 billion Wafer Fab Equipment (WFE) market outlook for CY24. This, together with management’s confidence in WFE market growth for 2025, mainly in NAND sector, paints a rosy picture for the company’s future performance.

Barclays upped its price target on shares of Lam Research Corporation (NASDAQ:LRCX) from $865.00 to $900.00. They gave an “Equal weight” rating on 5th June. Insider Monkey’s 1Q 2024 data of 920 hedge funds suggested that 78 hedge funds held positions in Lam Research Corporation (NASDAQ:LRCX).

Overall, LRCX ranks 7th on our list of best automation stocks to buy. While we acknowledge the potential of LRCX as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than LRCX but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.