Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Kaiser Aluminum Corp. (NASDAQ:KALU) has seen an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that kalu isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the recent hedge fund action encompassing Kaiser Aluminum Corp. (NASDAQ:KALU).

What does the smart money think about Kaiser Aluminum Corp. (NASDAQ:KALU)?

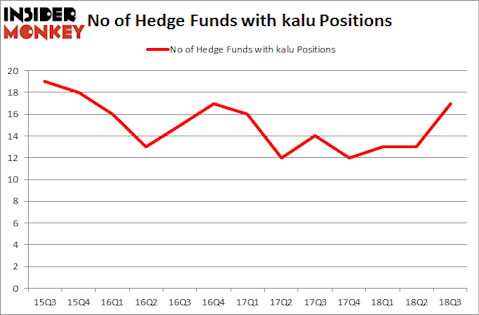

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 31% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards KALU over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Kaiser Aluminum Corp. (NASDAQ:KALU), which was worth $25.5 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $22.1 million worth of shares. Moreover, GLG Partners, Huber Capital Management, and Royce & Associates were also bullish on Kaiser Aluminum Corp. (NASDAQ:KALU), allocating a large percentage of their portfolios to this stock.

Now, some big names have been driving this bullishness. Millennium Management, managed by Israel Englander, established the most outsized position in Kaiser Aluminum Corp. (NASDAQ:KALU). Millennium Management had $9.6 million invested in the company at the end of the quarter. Ian Simm’s Impax Asset Management also made a $7.8 million investment in the stock during the quarter. The following funds were also among the new KALU investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and Brandon Haley’s Holocene Advisors.

Let’s also examine hedge fund activity in other stocks similar to Kaiser Aluminum Corp. (NASDAQ:KALU). These stocks are Myovant Sciences Ltd. (NYSE:MYOV), Alamos Gold Inc (NYSE:AGI), Gulfport Energy Corporation (NASDAQ:GPOR), and Theravance Biopharma Inc (NASDAQ:TBPH). This group of stocks’ market caps match KALU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MYOV | 7 | 133003 | 0 |

| AGI | 10 | 69476 | -2 |

| GPOR | 20 | 236743 | 3 |

| TBPH | 11 | 774277 | -1 |

| Average | 12 | 303375 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $303 million. That figure was $136 million in KALU’s case. Gulfport Energy Corporation (NASDAQ:GPOR) is the most popular stock in this table. On the other hand Myovant Sciences Ltd. (NYSE:MYOV) is the least popular one with only 7 bullish hedge fund positions. Kaiser Aluminum Corp. (NASDAQ:KALU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GPOR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.