Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Kadant Inc. (NYSE:KAI).

Hedge fund interest in Kadant Inc. (NYSE:KAI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Omega Flex, Inc. (NASDAQ:OFLX), Adient plc (NYSE:ADNT), and Provident Financial Services, Inc. (NYSE:PFS) to gather more data points. Our calculations also showed that KAI isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most traders, hedge funds are viewed as underperforming, outdated investment vehicles of years past. While there are greater than 8000 funds in operation at the moment, Our researchers choose to focus on the upper echelon of this club, approximately 850 funds. These investment experts manage bulk of the hedge fund industry’s total asset base, and by keeping track of their unrivaled stock picks, Insider Monkey has revealed a few investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Paul Tudor Jones of Tudor Investment Corp

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a gander at the latest hedge fund action surrounding Kadant Inc. (NYSE:KAI).

What have hedge funds been doing with Kadant Inc. (NYSE:KAI)?

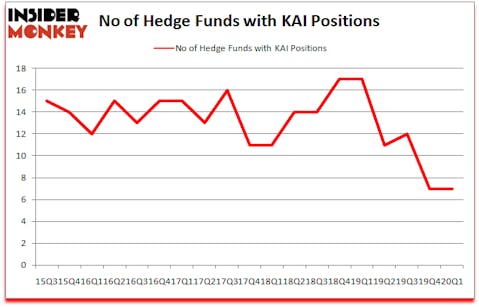

Heading into the second quarter of 2020, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in KAI over the last 18 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the most valuable position in Kadant Inc. (NYSE:KAI). Royce & Associates has a $50 million position in the stock, comprising 0.7% of its 13F portfolio. On Royce & Associates’s heels is Millennium Management, led by Israel Englander, holding a $3.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish include Renaissance Technologies, David Harding’s Winton Capital Management and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Royce & Associates allocated the biggest weight to Kadant Inc. (NYSE:KAI), around 0.68% of its 13F portfolio. Winton Capital Management is also relatively very bullish on the stock, earmarking 0.03 percent of its 13F equity portfolio to KAI.

Seeing as Kadant Inc. (NYSE:KAI) has witnessed bearish sentiment from the smart money, it’s safe to say that there was a specific group of money managers that slashed their entire stakes last quarter. It’s worth mentioning that Richard Driehaus’s Driehaus Capital dumped the biggest investment of all the hedgies followed by Insider Monkey, valued at about $7.8 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund sold off about $0.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Kadant Inc. (NYSE:KAI) but similarly valued. These stocks are Omega Flex, Inc. (NASDAQ:OFLX), Adient plc (NYSE:ADNT), Provident Financial Services, Inc. (NYSE:PFS), and Virtusa Corporation (NASDAQ:VRTU). All of these stocks’ market caps match KAI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OFLX | 3 | 3350 | -3 |

| ADNT | 32 | 204928 | -4 |

| PFS | 12 | 26202 | -4 |

| VRTU | 13 | 35689 | -1 |

| Average | 15 | 67542 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $58 million in KAI’s case. Adient plc (NYSE:ADNT) is the most popular stock in this table. On the other hand Omega Flex, Inc. (NASDAQ:OFLX) is the least popular one with only 3 bullish hedge fund positions. Kadant Inc. (NYSE:KAI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.9% in 2020 through June 10th and still beat the market by 14.2 percentage points. A small number of hedge funds were also right about betting on KAI as the stock returned 46.5% during the second quarter and outperformed the market by an even larger margin.

Follow Kadant Inc (NYSE:KAI)

Follow Kadant Inc (NYSE:KAI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.