Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Johnson Controls International plc (NYSE:JCI) in this article.

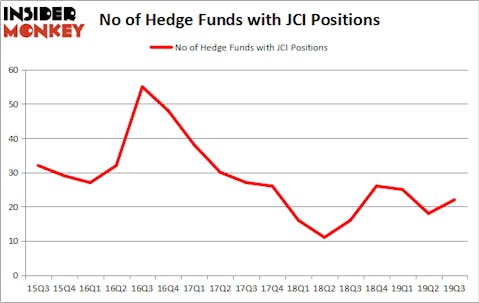

Johnson Controls International plc (NYSE:JCI) has experienced an increase in hedge fund interest recently. JCI was in 22 hedge funds’ portfolios at the end of the third quarter of 2019. There were 18 hedge funds in our database with JCI positions at the end of the previous quarter. Our calculations also showed that JCI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

David E. Shaw of D.E. Shaw

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the fresh hedge fund action surrounding Johnson Controls International plc (NYSE:JCI).

How are hedge funds trading Johnson Controls International plc (NYSE:JCI)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 22% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in JCI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Matt Sirovich and Jeremy Mindich’s Scopia Capital has the most valuable position in Johnson Controls International plc (NYSE:JCI), worth close to $154.4 million, corresponding to 9% of its total 13F portfolio. On Scopia Capital’s heels is Diamond Hill Capital, managed by Ric Dillon, which holds a $105.5 million position; 0.6% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors with similar optimism include David E. Shaw’s D E Shaw, Cliff Asness’s AQR Capital Management and Mario Gabelli’s GAMCO Investors. In terms of the portfolio weights assigned to each position Scopia Capital allocated the biggest weight to Johnson Controls International plc (NYSE:JCI), around 9.04% of its 13F portfolio. Gotham Asset Management is also relatively very bullish on the stock, dishing out 0.81 percent of its 13F equity portfolio to JCI.

As aggregate interest increased, key money managers have jumped into Johnson Controls International plc (NYSE:JCI) headfirst. Stevens Capital Management, managed by Matthew Tewksbury, assembled the biggest position in Johnson Controls International plc (NYSE:JCI). Stevens Capital Management had $4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $3 million investment in the stock during the quarter. The other funds with brand new JCI positions are Israel Englander’s Millennium Management, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Ronald Hua’s Qtron Investments.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Johnson Controls International plc (NYSE:JCI) but similarly valued. We will take a look at Eaton Corporation plc (NYSE:ETN), Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA), Humana Inc (NYSE:HUM), and Yum! Brands, Inc. (NYSE:YUM). This group of stocks’ market caps resemble JCI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETN | 31 | 463777 | -5 |

| BBVA | 9 | 275548 | 2 |

| HUM | 61 | 3527353 | -1 |

| YUM | 35 | 842106 | 5 |

| Average | 34 | 1277196 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1277 million. That figure was $599 million in JCI’s case. Humana Inc (NYSE:HUM) is the most popular stock in this table. On the other hand Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA) is the least popular one with only 9 bullish hedge fund positions. Johnson Controls International plc (NYSE:JCI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately JCI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); JCI investors were disappointed as the stock returned -2.4% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.