Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze JBG SMITH Properties (NYSE:JBGS) from the perspective of those elite funds.

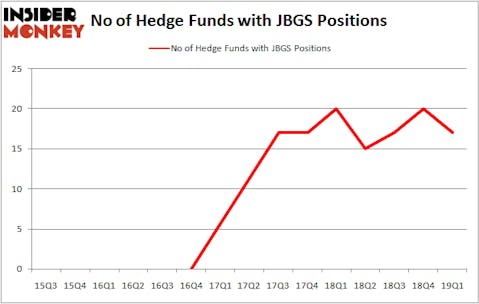

JBG SMITH Properties (NYSE:JBGS) shareholders have witnessed a decrease in enthusiasm from smart money of late. Our calculations also showed that JBGS isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Martin Whitman of Third Avenue Management

Let’s view the new hedge fund action regarding JBG SMITH Properties (NYSE:JBGS).

What does smart money think about JBG SMITH Properties (NYSE:JBGS)?

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards JBGS over the last 15 quarters. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, John Khoury’s Long Pond Capital has the number one position in JBG SMITH Properties (NYSE:JBGS), worth close to $81.6 million, amounting to 2.8% of its total 13F portfolio. The second largest stake is held by Sessa Capital, led by John Petry, holding a $75.4 million position; the fund has 10.5% of its 13F portfolio invested in the stock. Remaining peers with similar optimism encompass Martin Whitman’s Third Avenue Management, Eduardo Abush’s Waterfront Capital Partners and Joshua Nash’s Ulysses Management.

Due to the fact that JBG SMITH Properties (NYSE:JBGS) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of money managers who sold off their entire stakes heading into Q3. It’s worth mentioning that Joshua Nash’s Ulysses Management said goodbye to the biggest stake of the 700 funds watched by Insider Monkey, comprising an estimated $34.6 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also dropped its stock, about $1.9 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 3 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as JBG SMITH Properties (NYSE:JBGS) but similarly valued. We will take a look at ITT Inc. (NYSE:ITT), Crane Co. (NYSE:CR), Insperity Inc (NYSE:NSP), and Bemis Company, Inc. (NYSE:BMS). This group of stocks’ market valuations resemble JBGS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ITT | 22 | 395262 | -3 |

| CR | 22 | 334024 | -1 |

| NSP | 24 | 458494 | 0 |

| BMS | 29 | 373125 | 3 |

| Average | 24.25 | 390226 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $390 million. That figure was $313 million in JBGS’s case. Bemis Company, Inc. (NYSE:BMS) is the most popular stock in this table. On the other hand ITT Inc. (NYSE:ITT) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks JBG SMITH Properties (NYSE:JBGS) is even less popular than ITT. Hedge funds dodged a bullet by taking a bearish stance towards JBGS. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately JBGS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); JBGS investors were disappointed as the stock returned 0.6% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.