World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

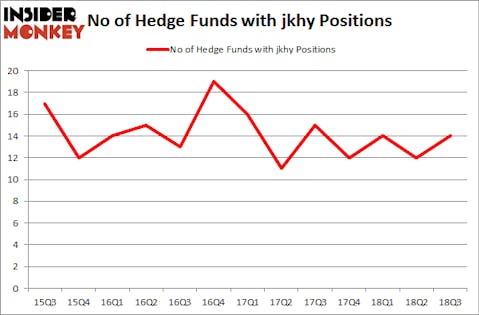

Jack Henry & Associates, Inc. (NASDAQ:JKHY) has seen an increase in hedge fund interest recently. JKHY was in 14 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with JKHY positions at the end of the previous quarter. Our calculations also showed that jkhy isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to go over the latest hedge fund action surrounding Jack Henry & Associates, Inc. (NASDAQ:JKHY).

What does the smart money think about Jack Henry & Associates, Inc. (NASDAQ:JKHY)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the second quarter of 2018. On the other hand, there were a total of 12 hedge funds with a bullish position in JKHY at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the most valuable position in Jack Henry & Associates, Inc. (NASDAQ:JKHY), worth close to $109.7 million, comprising 0.2% of its total 13F portfolio. Coming in second is Chuck Royce of Royce & Associates, with a $52.3 million position; 0.4% of its 13F portfolio is allocated to the stock. Some other professional money managers that hold long positions contain Cliff Asness’s AQR Capital Management, Noam Gottesman’s GLG Partners and Greg Poole’s Echo Street Capital Management.

As one would reasonably expect, some big names have been driving this bullishness. Balyasny Asset Management, managed by Dmitry Balyasny, assembled the most valuable position in Jack Henry & Associates, Inc. (NASDAQ:JKHY). Balyasny Asset Management had $0.9 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.8 million position during the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Jack Henry & Associates, Inc. (NASDAQ:JKHY) but similarly valued. These stocks are Domino’s Pizza, Inc. (NYSE:DPZ), Cenovus Energy Inc (NYSE:CVE), HEICO Corporation (NYSE:HEI), and HollyFrontier Corporation (NYSE:HFC). This group of stocks’ market values match JKHY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DPZ | 28 | 2296221 | 2 |

| CVE | 13 | 394053 | -9 |

| HEI | 30 | 866787 | 10 |

| HFC | 26 | 627597 | 1 |

| Average | 24.25 | 1046165 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.05 billion. That figure was $272 million in JKHY’s case. HEICO Corporation (NYSE:HEI) is the most popular stock in this table. On the other hand Cenovus Energy Inc (NYSE:CVE) is the least popular one with only 13 bullish hedge fund positions. Jack Henry & Associates, Inc. (NASDAQ:JKHY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HEI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.