Over the past decade, the New York Times has lost 80% of its market value, shedding asset after asset in a desperate bid to stay afloat. A final piece, its iconic Boston Globe newspaper and its related properties, was finally put up on sale recently – which means that the newspaper, founded in 1851, will be down to two remaining properties – its namesake newspaper and its European version, The International Herald Tribune. Is this the end of the road for the humbled New York Times, which is seemingly headed for the recycling bin, or will last ditch efforts to save the company with a paywall succeed?

Fourth Quarter Earnings

The New York Times reported its fourth quarter earnings on February 7, which topped estimates on both its top and bottom lines. However, both earnings and revenue still declined from the prior year quarter.

| Actual | Change from Prior Year Quarter | Analyst Forecast | |

| EPS | $0.32 | -5.88% | $0.31 |

| Revenue | $575.8 million | -10.45% | $570.42 million |

Source: The New York Times 4Q Report

Yet its shares immediately rallied 12% after the report. Was this optimism justified, for a company which has yet to prove that its core business is sustainable?

The Foolish Fundamentals

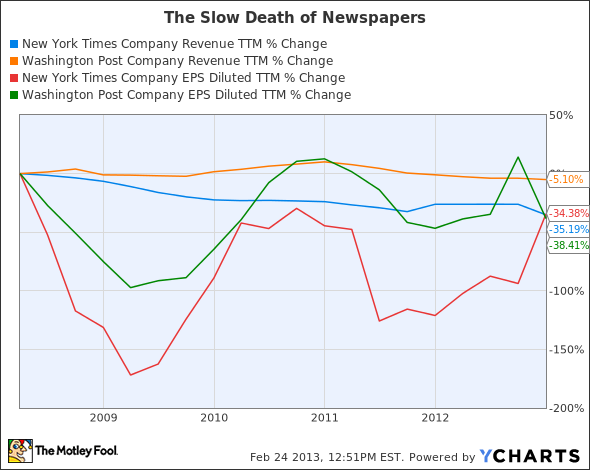

To grasp the desperation of The New York Times’ situation, we have to compare its top and bottom line growth to another dated media icon, The Washington Post Company (NYSE:WPO).

NYT Revenue TTM data by YCharts

The Washington Post has outperformed The New York Times over the past five years, thanks to its ownership of six television broadcast stations and Kaplan educational services – which have helped offset losses at its print media division. Warren Buffett is also a prominent investor in the Washington Post, which has kept it relevant in the minds of investors.

The New York Times, on the other hand, relies completely on print and digital revenue. It also has a high-profile investor in its corner – Mexican telecommunications magnate Carlos Slim, the world’s richest man – who owns an estimated 8.1% of the company.

But what do Slim and Buffett, the world’s 1st and 3rd richest men respectively, see in these aging newspapers? Is it financial strength?

NYT Cash and Equivalents data by YCharts

A look at The New York Times’ cash growth over the past five years reveals a surprising trend – it actually grew its cash and equivalents by 611%, ending the year with $955 million in cash.

Burning the furniture

However, most of those gains were generated by sales of its non-core assets, which included its broadcast media group (eight TV stations and two radio stations), its regional newspaper group (16 local newspapers), career search site Indeed.com, About.com, and its divestment from sports-related joint ventures. In other words, New York Times has been burning the furniture.

The New York Times has also taken losses with most of these sales. For example, it purchased About.com for $410 million in 2005, only to sell it to IAC/InteractiveCorp (NASDAQ:IACI) for $300 million.

The company is also expected to take a large loss by selling The Boston Globe, its venerable but troubled print franchise. It originally acquired The Globe for $1.1 billion in 1993. Although the company hasn’t put a price tag on The Globe yet, a local investment group once offered $35 million for The Globe in 2009, which The New York Times turned down. Back in 2009, The New York Times also did an industry survey to gauge how much The Globe was worth, and the results were grim – anything between a single dollar and $300 million.