We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Iridium Communications Inc (NASDAQ:IRDM), and what that likely means for the prospects of the company and its stock.

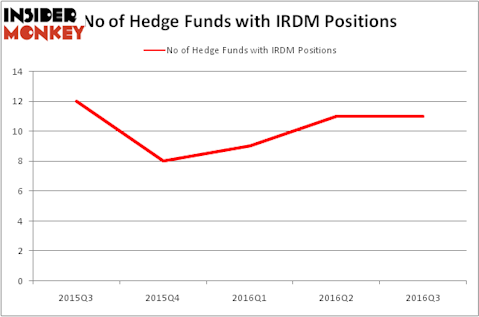

Hedge fund interest in Iridium Communications Inc (NASDAQ:IRDM) shares was flat during the third quarter. 11 hedge funds that we track owned the stock on September 30, same as on June 30. This is usually a negative indicator. At the end of this article we will also compare IRDM to other stocks including Cresud S.A.C.I.F. y A. (ADR) (NASDAQ:CRESY), LGI Homes Inc (NASDAQ:LGIH), and Orthofix International NV (NASDAQ:OFIX) to get a better sense of its popularity.

Follow Iridium Communications Inc. (NASDAQ:IRDM)

Follow Iridium Communications Inc. (NASDAQ:IRDM)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Daniel_Dash/Shutterstock.com

What have hedge funds been doing with Iridium Communications Inc (NASDAQ:IRDM)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards IRDM over the last 5 quarters, which has remained fairly stable. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Chuck Royce’s Royce & Associates has the most valuable position in Iridium Communications Inc (NASDAQ:IRDM), worth close to $6.5 million. Sitting at the No. 2 spot is Citadel Investment Group, led by Ken Griffin, holding a $5.1 million position. Other peers that hold long positions consist of David M. Knott’s Dorset Management and Renaissance Technologies, one of the largest hedge funds in the world. We should note that Dorset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that sold off their entire stakes in the stock during the third quarter. It’s worth mentioning that Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners sold off the largest investment of all the investors followed by Insider Monkey, totaling close to $0.4 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dropped its call options, about $0.3 million worth, while retaining its aforementioned long position.

Let’s check out hedge fund activity in other stocks similar to Iridium Communications Inc (NASDAQ:IRDM). We will take a look at Cresud S.A.C.I.F. y A. (ADR) (NASDAQ:CRESY), LGI Homes Inc (NASDAQ:LGIH), Orthofix International NV (NASDAQ:OFIX), and PHH Corporation (NYSE:PHH). This group of stocks’ market values match IRDM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRESY | 10 | 85875 | -1 |

| LGIH | 10 | 54893 | 0 |

| OFIX | 23 | 231332 | 3 |

| PHH | 20 | 271332 | 3 |

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $161 million. That figure was $19 million in IRDM’s case. Orthofix International NV (NASDAQ:OFIX) is the most popular stock in this table. On the other hand Cresud S.A.C.I.F. y A. (ADR) (NASDAQ:CRESY) is the least popular one with only 10 bullish hedge fund positions. Iridium Communications Inc (NASDAQ:IRDM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OFIX might be a better candidate to consider taking a long position in.

Disclosure: None