Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 37.6% in 2019 (through the end of November) and outperformed the broader market benchmark by 9.9 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Hedge fund interest in iQIYI, Inc. (NASDAQ:IQ) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare IQ to other stocks including Wheaton Precious Metals Corp. (NYSE:WPM), Teledyne Technologies Incorporated (NYSE:TDY), and EXACT Sciences Corporation (NASDAQ:EXAS) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a lot of gauges stock traders put to use to size up stocks. Two of the less known gauges are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can trounce the market by a solid margin (see the details here).

Chase Coleman of Tiger Global

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s check out the new hedge fund action encompassing iQIYI, Inc. (NASDAQ:IQ).

What does smart money think about iQIYI, Inc. (NASDAQ:IQ)?

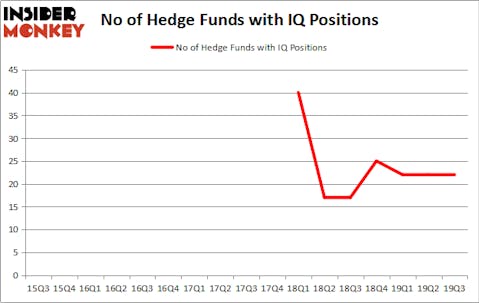

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in IQ a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Hillhouse Capital Management held the most valuable stake in iQIYI, Inc. (NASDAQ:IQ), which was worth $814.8 million at the end of the third quarter. On the second spot was Serenity Capital which amassed $41.4 million worth of shares. Coatue Management, Tiger Pacific Capital, and Tiger Global Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Hillhouse Capital Management allocated the biggest weight to iQIYI, Inc. (NASDAQ:IQ), around 11.2% of its 13F portfolio. Serenity Capital is also relatively very bullish on the stock, designating 9.56 percent of its 13F equity portfolio to IQ.

Since iQIYI, Inc. (NASDAQ:IQ) has experienced falling interest from the smart money, it’s easy to see that there is a sect of hedgies that decided to sell off their positions entirely in the third quarter. Intriguingly, Yi Xin’s Ariose Capital cut the largest position of the 750 funds tracked by Insider Monkey, comprising an estimated $12.3 million in stock, and Neal Nathani and Darren Dinneen’s Totem Point Management was right behind this move, as the fund dumped about $7 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to iQIYI, Inc. (NASDAQ:IQ). These stocks are Wheaton Precious Metals Corp. (NYSE:WPM), Teledyne Technologies Incorporated (NYSE:TDY), EXACT Sciences Corporation (NASDAQ:EXAS), and Wynn Resorts, Limited (NASDAQ:WYNN). This group of stocks’ market caps match IQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WPM | 27 | 326903 | 8 |

| TDY | 29 | 686123 | 3 |

| EXAS | 35 | 586487 | 3 |

| WYNN | 36 | 1171401 | -3 |

| Average | 31.75 | 692729 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $693 million. That figure was $967 million in IQ’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand Wheaton Precious Metals Corp. (NYSE:WPM) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks iQIYI, Inc. (NASDAQ:IQ) is even less popular than WPM. Hedge funds clearly dropped the ball on IQ as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on IQ as the stock returned 18.7% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.