A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on IPG Photonics Corporation (NASDAQ:IPGP).

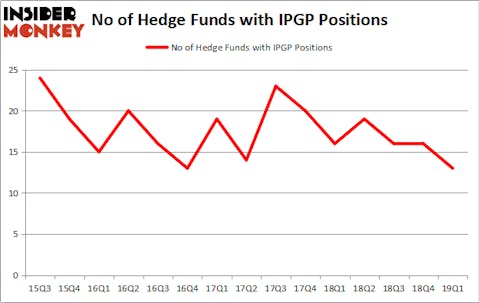

IPG Photonics Corporation (NASDAQ:IPGP) was in 13 hedge funds’ portfolios at the end of March. IPGP investors should pay attention to a decrease in support from the world’s most elite money managers of late. There were 16 hedge funds in our database with IPGP positions at the end of the previous quarter. Our calculations also showed that IPGP isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action surrounding IPG Photonics Corporation (NASDAQ:IPGP).

How have hedgies been trading IPG Photonics Corporation (NASDAQ:IPGP)?

Heading into the second quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in IPGP a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

More specifically, Two Sigma Advisors was the largest shareholder of IPG Photonics Corporation (NASDAQ:IPGP), with a stake worth $42.3 million reported as of the end of March. Trailing Two Sigma Advisors was Royce & Associates, which amassed a stake valued at $31.5 million. Fisher Asset Management, Balyasny Asset Management, and Highbridge Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because IPG Photonics Corporation (NASDAQ:IPGP) has experienced declining sentiment from the smart money, it’s easy to see that there lies a certain “tier” of hedge funds who sold off their entire stakes in the third quarter. At the top of the heap, Jim Simons’s Renaissance Technologies sold off the biggest stake of the 700 funds tracked by Insider Monkey, valued at about $32.1 million in call options, and Matthew Hulsizer’s PEAK6 Capital Management was right behind this move, as the fund dropped about $3.5 million worth. These transactions are interesting, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to IPG Photonics Corporation (NASDAQ:IPGP). These stocks are Formula One Group (NASDAQ:FWONA), Etsy Inc (NASDAQ:ETSY), SEI Investments Company (NASDAQ:SEIC), and Athene Holding Ltd. (NYSE:ATH). This group of stocks’ market valuations are closest to IPGP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FWONA | 21 | 321009 | 2 |

| ETSY | 39 | 1202165 | 0 |

| SEIC | 24 | 334310 | -1 |

| ATH | 35 | 1311162 | -8 |

| Average | 29.75 | 792162 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $792 million. That figure was $120 million in IPGP’s case. Etsy Inc (NASDAQ:ETSY) is the most popular stock in this table. On the other hand Formula One Group (NASDAQ:FWONA) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks IPG Photonics Corporation (NASDAQ:IPGP) is even less popular than FWONA. Hedge funds dodged a bullet by taking a bearish stance towards IPGP. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately IPGP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); IPGP investors were disappointed as the stock returned -7.3% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.