After a lengthy stretch of outperformance, small-cap stocks suffered from July 2015 through June 2016, as heightened global economic fears led investors to flee to the safe havens of large-cap stocks and other instruments. Those stocks outperformed small-caps by about 10 percentage points during that time, with small-cap healthcare stocks being particularly hard hit. However, the tide has since turned in a big way, as evidenced by small-caps toppling their large-cap peers by 5 percentage points in the third quarter, and by another 5 percentage points in the first seven weeks of the fourth quarter. In this article, we’ll analyze how this shift affected hedge funds’ Q3 trading of Interactive Brokers Group, Inc. (NASDAQ:IBKR) and see how the stock is affected by the recent hedge fund activity.

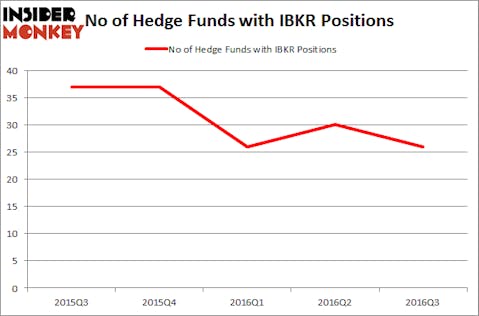

Interactive Brokers Group, Inc. (NASDAQ:IBKR) was in 26 hedge funds’ portfolios at the end of the third quarter of 2016. IBKR shareholders have witnessed a decrease in support from the world’s most successful money managers in recent months. There were 30 hedge funds in our database with IBKR positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), SK Telecom Co., Ltd. (ADR) (NYSE:SKM), and Credicorp Ltd. (USA) (NYSE:BAP) to gather more data points.

Follow Interactive Brokers Group Inc. (NASDAQ:IBKR)

Follow Interactive Brokers Group Inc. (NASDAQ:IBKR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

lassedesignen/Shutterstock.com

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 13% from the second quarter of 2016. By comparison, 37 hedge funds held shares or bullish call options in IBKR heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Teton Capital, led by Quincy Lee, holds the largest position in Interactive Brokers Group, Inc. (NASDAQ:IBKR). Ancient Art (Teton Capital) has a $117 million position in the stock, comprising 21.4% of its 13F portfolio. Coming in second is Brian Bares of Bares Capital Management, with a $112.6 million position; 6.7% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism include Allan Mecham and Ben Raybould’s Arlington Value Capital, Ted Kang’s Kylin Management and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital. We should note that Arlington Value Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually cut their positions entirely. At the top of the heap, Matt Sirovich and Jeremy Mindich’s Scopia Capital cut the biggest position of the 700 funds watched by Insider Monkey, comprising an estimated $99.3 million in stock. Scott Phillips’ fund, Latimer Light Capital, also dumped its stock, about $22 million worth.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Interactive Brokers Group, Inc. (NASDAQ:IBKR) but similarly valued. We will take a look at Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), SK Telecom Co., Ltd. (ADR) (NYSE:SKM), Credicorp Ltd. (USA) (NYSE:BAP), and Ball Corporation (NYSE:BLL). This group of stocks’ market valuations match IBKR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FCX | 36 | 1550951 | 6 |

| SKM | 12 | 80765 | 2 |

| BAP | 22 | 481522 | 1 |

| BLL | 35 | 1617854 | -7 |

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $933 million. That figure was $589 million in IBKR’s case. Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX) is the most popular stock in this table. On the other hand SK Telecom Co., Ltd. (ADR) (NYSE:SKM) is the least popular one with only 12 bullish hedge fund positions. Interactive Brokers Group, Inc. (NASDAQ:IBKR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard FCX might be a better candidate to consider taking a long position in.

Disclosure: None