The market has been volatile in the last 6 months as the Federal Reserve continued its rate hikes and then abruptly reversed its stance and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q4 and the beginning of Q1. In this article, we analyze what the smart money thinks of ING Groep N.V. (NYSE:ING) and find out how it is affected by hedge funds’ moves.

ING Groep N.V. (NYSE:ING) has seen an increase in support from the world’s most elite money managers in recent months. ING was in 10 hedge funds’ portfolios at the end of March. There were 7 hedge funds in our database with ING holdings at the end of the previous quarter. Our calculations also showed that ing isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Matthew Hulsizer of PEAK6 Capital

We’re going to go over the key hedge fund action surrounding ING Groep N.V. (NYSE:ING).

How are hedge funds trading ING Groep N.V. (NYSE:ING)?

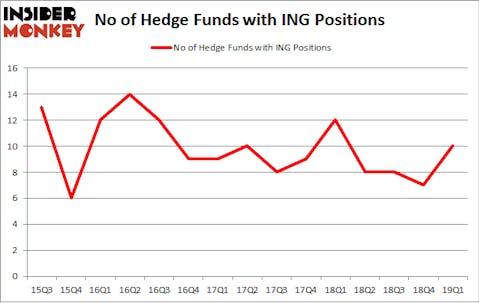

At the end of the first quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 43% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in ING over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of ING Groep N.V. (NYSE:ING), with a stake worth $472.1 million reported as of the end of March. Trailing Fisher Asset Management was Orbis Investment Management, which amassed a stake valued at $8.9 million. Renaissance Technologies, Citadel Investment Group, and PEAK6 Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, some big names were leading the bulls’ herd. Orbis Investment Management, managed by William B. Gray, established the most valuable position in ING Groep N.V. (NYSE:ING). Orbis Investment Management had $8.9 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.8 million position during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Thomas Bailard’s Bailard Inc.

Let’s now take a look at hedge fund activity in other stocks similar to ING Groep N.V. (NYSE:ING). We will take a look at America Movil SAB de CV (NYSE:AMX), Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), Illinois Tool Works Inc. (NYSE:ITW), and UBS Group AG (NYSE:UBS). This group of stocks’ market valuations match ING’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMX | 14 | 234341 | 2 |

| VRTX | 45 | 2285930 | 6 |

| ITW | 27 | 315022 | -1 |

| UBS | 11 | 750775 | 0 |

| Average | 24.25 | 896517 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $897 million. That figure was $492 million in ING’s case. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is the most popular stock in this table. On the other hand UBS Group AG (NYSE:UBS) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks ING Groep N.V. (NYSE:ING) is even less popular than UBS. Hedge funds dodged a bullet by taking a bearish stance towards ING. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately ING wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ING investors were disappointed as the stock returned -2.6% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.