Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of March. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Immersion Corporation (NASDAQ:IMMR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

Is Immersion Corporation (NASDAQ:IMMR) the right investment to pursue these days? Hedge funds are in a bullish mood. The number of bullish hedge fund positions rose by 3 lately. Our calculations also showed that immr isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are numerous signals market participants can use to assess their stock investments. A couple of the less utilized signals are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the top hedge fund managers can beat the broader indices by a very impressive margin (see the details here).

We’re going to view the new hedge fund action encompassing Immersion Corporation (NASDAQ:IMMR).

Hedge fund activity in Immersion Corporation (NASDAQ:IMMR)

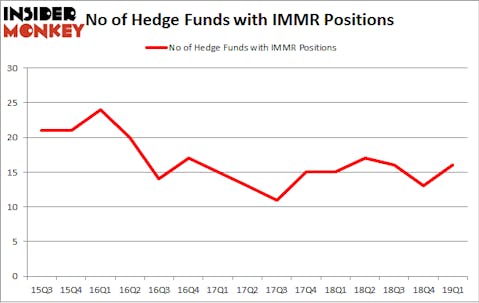

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 23% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards IMMR over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Immersion Corporation (NASDAQ:IMMR) was held by Raging Capital Management, which reported holding $40.3 million worth of stock at the end of March. It was followed by Shannon River Fund Management with a $12.4 million position. Other investors bullish on the company included VIEX Capital Advisors, GLG Partners, and AQR Capital Management.

With a general bullishness amongst the heavyweights, key money managers have jumped into Immersion Corporation (NASDAQ:IMMR) headfirst. Fondren Management, managed by Bradley Louis Radoff, initiated the most valuable position in Immersion Corporation (NASDAQ:IMMR). Fondren Management had $0.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $0.2 million investment in the stock during the quarter. The other funds with brand new IMMR positions are Jeffrey Talpins’s Element Capital Management, Israel Englander’s Millennium Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Immersion Corporation (NASDAQ:IMMR) but similarly valued. We will take a look at Global Medical REIT Inc. (NYSE:GMRE), MutualFirst Financial, Inc. (NASDAQ:MFSF), PDL Community Bancorp (NASDAQ:PDLB), and Concrete Pumping Holdings, Inc. (NASDAQ:BBCP). All of these stocks’ market caps resemble IMMR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GMRE | 16 | 34770 | 7 |

| MFSF | 3 | 24850 | 0 |

| PDLB | 2 | 1874 | 0 |

| BBCP | 5 | 18461 | -5 |

| Average | 6.5 | 19989 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $87 million in IMMR’s case. Global Medical REIT Inc. (NYSE:GMRE) is the most popular stock in this table. On the other hand PDL Community Bancorp (NASDAQ:PDLB) is the least popular one with only 2 bullish hedge fund positions. Immersion Corporation (NASDAQ:IMMR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately IMMR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on IMMR were disappointed as the stock returned -8.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.