Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

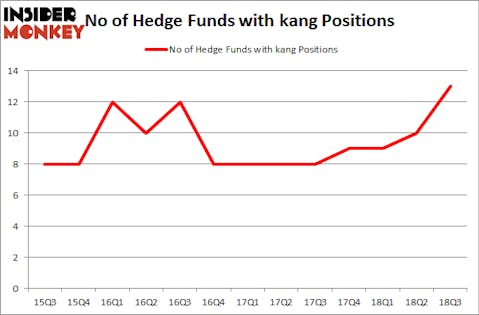

Is iKang Healthcare Group Inc (NASDAQ:KANG) going to take off soon? Money managers are getting more optimistic. The number of long hedge fund positions moved up by 3 lately. Our calculations also showed that kang isn’t among the 30 most popular stocks among hedge funds. KANG was in 13 hedge funds’ portfolios at the end of the third quarter of 2018. There were 10 hedge funds in our database with KANG positions at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a gander at the key hedge fund action regarding iKang Healthcare Group Inc (NASDAQ:KANG).

What does the smart money think about iKang Healthcare Group Inc (NASDAQ:KANG)?

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards KANG over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Among these funds, Blue Mountain Capital held the most valuable stake in iKang Healthcare Group Inc (NASDAQ:KANG), which was worth $115.8 million at the end of the third quarter. On the second spot was Hillhouse Capital Management which amassed $52.9 million worth of shares. Moreover, GLG Partners, QVT Financial, and Two Sigma Advisors were also bullish on iKang Healthcare Group Inc (NASDAQ:KANG), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key money managers have been driving this bullishness. PEAK6 Capital Management, managed by Matthew Hulsizer, established the biggest position in iKang Healthcare Group Inc (NASDAQ:KANG). PEAK6 Capital Management had $1.7 million invested in the company at the end of the quarter. Robert Emil Zoellner’s Alpine Associates also initiated a $1.5 million position during the quarter. The other funds with new positions in the stock are Alec Litowitz and Ross Laser’s Magnetar Capital, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as iKang Healthcare Group Inc (NASDAQ:KANG) but similarly valued. We will take a look at Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA), Playa Hotels & Resorts N.V. (NASDAQ:PLYA), Saul Centers Inc (NYSE:BFS), and Select Energy Services, Inc. (NYSE:WTTR). All of these stocks’ market caps are closest to KANG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KNSA | 9 | 282489 | -5 |

| PLYA | 15 | 485890 | -4 |

| BFS | 7 | 26248 | 1 |

| WTTR | 14 | 104007 | 3 |

| Average | 11.25 | 224659 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $225 million. That figure was $226 million in KANG’s case. Playa Hotels & Resorts N.V. (NASDAQ:PLYA) is the most popular stock in this table. On the other hand Saul Centers Inc (NYSE:BFS) is the least popular one with only 7 bullish hedge fund positions. iKang Healthcare Group Inc (NASDAQ:KANG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PLYA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.