Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards IDEXX Laboratories, Inc. (NASDAQ:IDXX) changed recently.

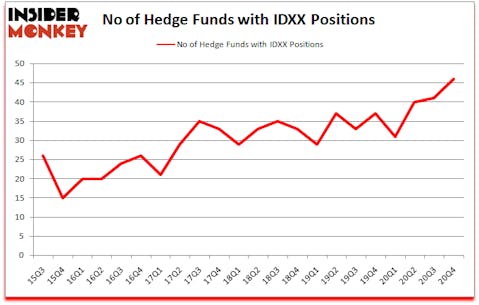

Is IDXX stock a buy or sell? IDEXX Laboratories, Inc. (NASDAQ:IDXX) was in 46 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 41. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. IDXX has seen an increase in enthusiasm from smart money lately. There were 41 hedge funds in our database with IDXX holdings at the end of September. Our calculations also showed that IDXX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 124 percentage points since March 2017 (see the details here).

Kris Jenner of Rock Springs Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. Recently Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best biotech stocks to invest in to pick the next stock that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article).With all of this in mind we’re going to take a look at the new hedge fund action regarding IDEXX Laboratories, Inc. (NASDAQ:IDXX).

Do Hedge Funds Think IDXX Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 46 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from the previous quarter. By comparison, 37 hedge funds held shares or bullish call options in IDXX a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Fundsmith LLP held the most valuable stake in IDEXX Laboratories, Inc. (NASDAQ:IDXX), which was worth $2112.7 million at the end of the fourth quarter. On the second spot was Select Equity Group which amassed $106.5 million worth of shares. Echo Street Capital Management, Rock Springs Capital Management, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Fundsmith LLP allocated the biggest weight to IDEXX Laboratories, Inc. (NASDAQ:IDXX), around 7% of its 13F portfolio. Montanaro Asset Management is also relatively very bullish on the stock, setting aside 5.08 percent of its 13F equity portfolio to IDXX.

Consequently, key hedge funds were leading the bulls’ herd. Montanaro Asset Management, managed by Charles Montanaro, created the biggest position in IDEXX Laboratories, Inc. (NASDAQ:IDXX). Montanaro Asset Management had $30.1 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $9.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Michael Kharitonov and Jon David McAuliffe’s Voleon Capital, Matthew Hulsizer’s PEAK6 Capital Management, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors.

Let’s check out hedge fund activity in other stocks similar to IDEXX Laboratories, Inc. (NASDAQ:IDXX). These stocks are Constellation Brands, Inc. (NYSE:STZ), Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG), The Kraft Heinz Company (NASDAQ:KHC), Metlife Inc (NYSE:MET), Roku, Inc. (NASDAQ:ROKU), Align Technology, Inc. (NASDAQ:ALGN), and Electronic Arts Inc. (NASDAQ:EA). This group of stocks’ market valuations are closest to IDXX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STZ | 58 | 1768371 | 5 |

| SMFG | 10 | 92749 | 2 |

| KHC | 36 | 11558217 | -3 |

| MET | 37 | 983027 | 1 |

| ROKU | 60 | 3237943 | 1 |

| ALGN | 50 | 2480630 | 3 |

| EA | 50 | 1050954 | -12 |

| Average | 43 | 3024556 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43 hedge funds with bullish positions and the average amount invested in these stocks was $3025 million. That figure was $2698 million in IDXX’s case. Roku, Inc. (NASDAQ:ROKU) is the most popular stock in this table. On the other hand Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG) is the least popular one with only 10 bullish hedge fund positions. IDEXX Laboratories, Inc. (NASDAQ:IDXX) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for IDXX is 76. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and beat the market again by 0.8 percentage points. Unfortunately IDXX wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on IDXX were disappointed as the stock returned -3% since the end of December (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Idexx Laboratories Inc (NASDAQ:IDXX)

Follow Idexx Laboratories Inc (NASDAQ:IDXX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.