Is Huntington Ingalls Industries Inc (NYSE:HII) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

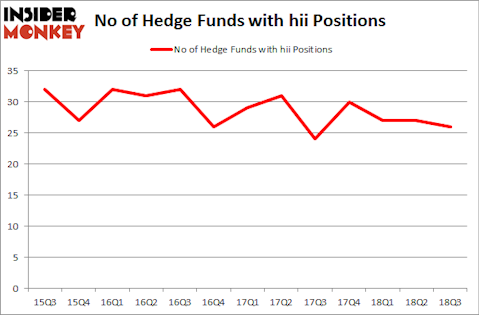

Is Huntington Ingalls Industries Inc (NYSE:HII) a sound investment right now? Hedge funds are getting less optimistic. The number of long hedge fund positions were trimmed by 1 recently. Our calculations also showed that hii isn’t among the 30 most popular stocks among hedge funds. HII was in 26 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with HII positions at the end of the previous quarter.

To the average investor there are a lot of gauges stock market investors can use to grade stocks. A couple of the most underrated gauges are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outclass their index-focused peers by a superb margin (see the details here).

We’re going to take a look at the latest hedge fund action surrounding Huntington Ingalls Industries Inc (NYSE:HII).

Hedge fund activity in Huntington Ingalls Industries Inc (NYSE:HII)

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the previous quarter. The graph below displays the number of hedge funds with bullish position in HII over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of Huntington Ingalls Industries Inc (NYSE:HII), with a stake worth $445.4 million reported as of the end of September. Trailing AQR Capital Management was East Side Capital (RR Partners), which amassed a stake valued at $71 million. Marshall Wace LLP, GLG Partners, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Huntington Ingalls Industries Inc (NYSE:HII) has experienced bearish sentiment from the aggregate hedge fund industry, we can see that there was a specific group of money managers who sold off their full holdings heading into Q3. Intriguingly, Ken Griffin’s Citadel Investment Group dropped the largest investment of all the hedgies followed by Insider Monkey, valued at close to $23.9 million in stock. Rob Citrone’s fund, Discovery Capital Management, also sold off its stock, about $13.4 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Huntington Ingalls Industries Inc (NYSE:HII). These stocks are PVH Corp (NYSE:PVH), Tractor Supply Company (NASDAQ:TSCO), Vail Resorts, Inc. (NYSE:MTN), and Brookfield Infrastructure Partners L.P. (NYSE:BIP). This group of stocks’ market values are closest to HII’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PVH | 44 | 1292262 | 8 |

| TSCO | 34 | 968657 | 2 |

| MTN | 30 | 808461 | 1 |

| BIP | 6 | 15818 | -2 |

| Average | 28.5 | 771300 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.5 hedge funds with bullish positions and the average amount invested in these stocks was $771 million. That figure was $746 million in HII’s case. PVH Corp (NYSE:PVH) is the most popular stock in this table. On the other hand Brookfield Infrastructure Partners L.P. (NYSE:BIP) is the least popular one with only 6 bullish hedge fund positions. Huntington Ingalls Industries Inc (NYSE:HII) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PVH might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.