The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 866 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their March 31st holdings, data that is available nowhere else. Should you consider Hostess Brands, Inc. (NASDAQ:TWNK) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

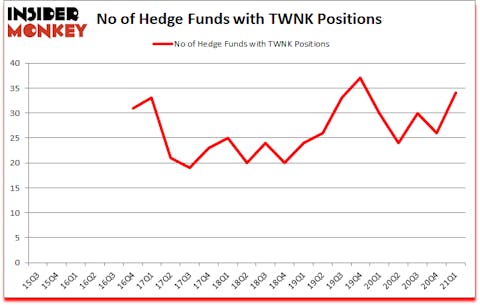

Is TWNK a good stock to buy? Hostess Brands, Inc. (NASDAQ:TWNK) investors should be aware of an increase in hedge fund sentiment in recent months. Hostess Brands, Inc. (NASDAQ:TWNK) was in 34 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 37. There were 26 hedge funds in our database with TWNK positions at the end of the fourth quarter. Our calculations also showed that TWNK isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In today’s marketplace there are numerous signals market participants have at their disposal to value stocks. A couple of the less known signals are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best hedge fund managers can trounce their index-focused peers by a healthy amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s analyze the new hedge fund action surrounding Hostess Brands, Inc. (NASDAQ:TWNK).

Do Hedge Funds Think TWNK Is A Good Stock To Buy Now?

At the end of March, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 31% from the fourth quarter of 2020. By comparison, 30 hedge funds held shares or bullish call options in TWNK a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Hostess Brands, Inc. (NASDAQ:TWNK) was held by Cardinal Capital, which reported holding $109.2 million worth of stock at the end of December. It was followed by Millennium Management with a $72.5 million position. Other investors bullish on the company included Renaissance Technologies, GLG Partners, and Armistice Capital. In terms of the portfolio weights assigned to each position Cardinal Capital allocated the biggest weight to Hostess Brands, Inc. (NASDAQ:TWNK), around 2.67% of its 13F portfolio. Diametric Capital is also relatively very bullish on the stock, designating 1.26 percent of its 13F equity portfolio to TWNK.

Now, specific money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the biggest position in Hostess Brands, Inc. (NASDAQ:TWNK). Arrowstreet Capital had $7.2 million invested in the company at the end of the quarter. John D. Gillespie’s Prospector Partners also initiated a $2.1 million position during the quarter. The other funds with brand new TWNK positions are Paul Tudor Jones’s Tudor Investment Corp, Lee Ainslie’s Maverick Capital, and Jinghua Yan’s TwinBeech Capital.

Let’s also examine hedge fund activity in other stocks similar to Hostess Brands, Inc. (NASDAQ:TWNK). These stocks are Sumo Logic, Inc. (NASDAQ:SUMO), The Macerich Company (NYSE:MAC), Enviva Partners, LP (NYSE:EVA), Inovio Pharmaceuticals Inc (NYSE:INO), Urban Edge Properties (NYSE:UE), The Duckhorn Portfolio, Inc. (NYSE:NAPA), and CVR Energy, Inc. (NYSE:CVI). This group of stocks’ market valuations are closest to TWNK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SUMO | 14 | 139164 | -2 |

| MAC | 19 | 172091 | 3 |

| EVA | 7 | 250065 | -2 |

| INO | 11 | 53390 | -5 |

| UE | 12 | 95718 | 0 |

| NAPA | 18 | 96294 | 18 |

| CVI | 18 | 1436736 | -1 |

| Average | 14.1 | 320494 | 1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.1 hedge funds with bullish positions and the average amount invested in these stocks was $320 million. That figure was $338 million in TWNK’s case. The Macerich Company (NYSE:MAC) is the most popular stock in this table. On the other hand Enviva Partners, LP (NYSE:EVA) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Hostess Brands, Inc. (NASDAQ:TWNK) is more popular among hedge funds. Our overall hedge fund sentiment score for TWNK is 87.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 19.3% in 2021 through June 25th but still managed to beat the market by 4.8 percentage points. Hedge funds were also right about betting on TWNK as the stock returned 15.3% since the end of March (through 6/25) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Hostess Brands Inc. (NASDAQ:TWNK)

Follow Hostess Brands Inc. (NASDAQ:TWNK)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Hardware Stocks to Buy Now

- 15 Biggest Money Transfer Companies In The World

Disclosure: None. This article was originally published at Insider Monkey.