The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Herc Holdings Inc. (NYSE:HRI) based on those filings.

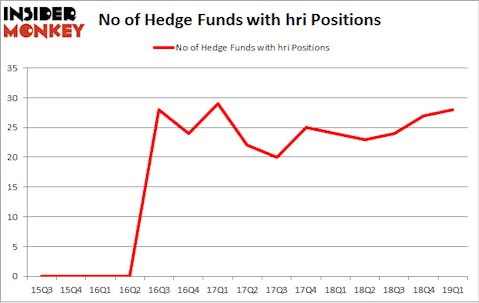

Is Herc Holdings Inc. (NYSE:HRI) going to take off soon? Hedge funds are turning bullish. The number of long hedge fund bets advanced by 1 lately. Our calculations also showed that hri isn’t among the 30 most popular stocks among hedge funds. HRI was in 28 hedge funds’ portfolios at the end of March. There were 27 hedge funds in our database with HRI positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the latest hedge fund action surrounding Herc Holdings Inc. (NYSE:HRI).

What have hedge funds been doing with Herc Holdings Inc. (NYSE:HRI)?

Heading into the second quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from one quarter earlier. On the other hand, there were a total of 24 hedge funds with a bullish position in HRI a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Icahn Capital LP, managed by Carl Icahn, holds the number one position in Herc Holdings Inc. (NYSE:HRI). Icahn Capital LP has a $175.2 million position in the stock, comprising 0.7% of its 13F portfolio. On Icahn Capital LP’s heels is GAMCO Investors, led by Mario Gabelli, holding a $152.4 million position; 1.2% of its 13F portfolio is allocated to the stock. Some other peers that are bullish comprise Jared Nussbaum’s Nut Tree Capital, Chuck Royce’s Royce & Associates and Jonathan Kolatch’s Redwood Capital Management.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. ACK Asset Management, managed by Richard S. Meisenberg, established the most valuable position in Herc Holdings Inc. (NYSE:HRI). ACK Asset Management had $13.6 million invested in the company at the end of the quarter. Robert Bishop’s Impala Asset Management also made a $6.8 million investment in the stock during the quarter. The other funds with brand new HRI positions are Joel Greenblatt’s Gotham Asset Management, Alec Litowitz and Ross Laser’s Magnetar Capital, and Mike Vranos’s Ellington.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Herc Holdings Inc. (NYSE:HRI) but similarly valued. We will take a look at Codexis, Inc. (NASDAQ:CDXS), Heritage Financial Corporation (NASDAQ:HFWA), Hecla Mining Company (NYSE:HL), and Contura Energy, Inc. (NYSE:CTRA). This group of stocks’ market values are closest to HRI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDXS | 11 | 294486 | -2 |

| HFWA | 7 | 54687 | -1 |

| HL | 9 | 17616 | 0 |

| CTRA | 32 | 448228 | 4 |

| Average | 14.75 | 203754 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $204 million. That figure was $485 million in HRI’s case. Contura Energy, Inc. (NYSE:CTRA) is the most popular stock in this table. On the other hand Heritage Financial Corporation (NASDAQ:HFWA) is the least popular one with only 7 bullish hedge fund positions. Herc Holdings Inc. (NYSE:HRI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately HRI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HRI were disappointed as the stock returned -8.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.