We at Insider Monkey have gone over 742 13F filings that hedge funds and prominent investors are required to file by the government. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article, we look at what those funds think of Healthcare Trust Of America Inc (NYSE:HTA) based on that data.

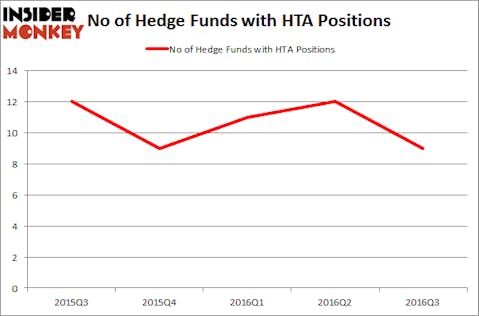

Healthcare Trust Of America Inc (NYSE:HTA) was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. HTA investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. There were 12 hedge funds in our database with HTA holdings at the end of the previous quarter. At the end of this article we will also compare HTA to other stocks including Cognex Corporation (NASDAQ:CGNX), Taubman Centers, Inc. (NYSE:TCO), and Endo Health Solutions Inc (NASDAQ:ENDP) to get a better sense of its popularity.

Follow Healthcare Realty Trust Inc (NYSE:HR)

Follow Healthcare Realty Trust Inc (NYSE:HR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Andrei Rahalski/Shutterstock.com

Keeping this in mind, we’re going to go over the fresh action encompassing Healthcare Trust Of America Inc (NYSE:HTA).

How are hedge funds trading Healthcare Trust Of America Inc (NYSE:HTA)?

Heading into the fourth quarter of 2016, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HTA over the last 5 quarters. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Millennium Management, one of the 10 largest hedge funds in the world, holds the most valuable position in Healthcare Trust Of America Inc (NYSE:HTA). Millennium Management has a $19.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Jim Simons of Renaissance Technologies, with a $18.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining peers that are bullish include Andrew Sandler’s Sandler Capital Management, Cliff Asness’s AQR Capital Management and Greg Poole’s Echo Street Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that Healthcare Trust Of America Inc (NYSE:HTA) has experienced bearish sentiment from the smart money, it’s safe to say that there is a sect of hedge funds who sold off their entire stakes heading into Q4. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the largest position of all the hedgies monitored by Insider Monkey, totaling close to $6.7 million in stock. George Hall’s fund, Clinton Group, also said goodbye to its stock, about $0.4 million worth.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Healthcare Trust Of America Inc (NYSE:HTA) but similarly valued. We will take a look at Cognex Corporation (NASDAQ:CGNX), Taubman Centers, Inc. (NYSE:TCO), Endo Health Solutions Inc (NASDAQ:ENDP), and Genesis Energy, L.P. (NYSE:GEL). This group of stocks’ market valuations match HTA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CGNX | 11 | 256491 | 3 |

| TCO | 19 | 436312 | 1 |

| ENDP | 32 | 797272 | -4 |

| GEL | 7 | 22104 | 0 |

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $378 million. That figure was $61 million in HTA’s case. Endo Health Solutions Inc (NASDAQ:ENDP) is the most popular stock in this table. On the other hand Genesis Energy, L.P. (NYSE:GEL) is the least popular one with only 7 bullish hedge fund positions. Healthcare Trust Of America Inc (NYSE:HTA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ENDP might be a better candidate to consider taking a long position in.

Suggested Articles:

Countries With Highest Average IQ In The World

High Margin Food Products To Build A Business Around

Countries With The Lowest Cost Of Living

States With The Lowest Substance Abuse Rates