During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Healthcare Services Group, Inc. (NASDAQ:HCSG) and see how the stock is affected by the recent hedge fund activity.

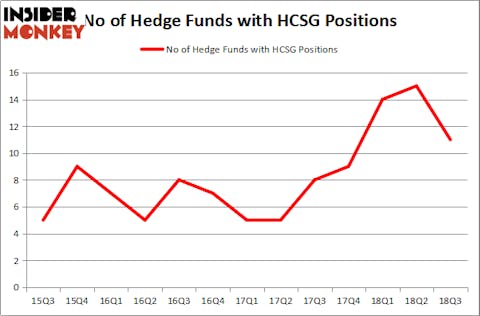

Is Healthcare Services Group, Inc. (NASDAQ:HCSG) a buy right now? Money managers are becoming less hopeful. The number of bullish hedge fund bets decreased by 4 lately. Our calculations also showed that HCSG isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are perceived as unimportant, outdated investment tools of yesteryear. While there are more than 8,000 funds trading today, We look at the masters of this club, around 700 funds. It is estimated that this group of investors oversee the majority of the smart money’s total asset base, and by tracking their highest performing investments, Insider Monkey has found various investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the fresh hedge fund action regarding Healthcare Services Group, Inc. (NASDAQ:HCSG).

What does the smart money think about Healthcare Services Group, Inc. (NASDAQ:HCSG)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -27% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HCSG over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

The largest stake in Healthcare Services Group, Inc. (NASDAQ:HCSG) was held by Echo Street Capital Management, which reported holding $14.9 million worth of stock at the end of September. It was followed by Royce & Associates with a $6.9 million position. Other investors bullish on the company included Citadel Investment Group, Markel Gayner Asset Management, and Two Sigma Advisors.

Due to the fact that Healthcare Services Group, Inc. (NASDAQ:HCSG) has faced falling interest from hedge fund managers, logic holds that there exists a select few fund managers that elected to cut their full holdings in the third quarter. Intriguingly, Steve Cohen’s Point72 Asset Management sold off the largest position of the “upper crust” of funds followed by Insider Monkey, totaling close to $18.2 million in stock. Jim Simons’s fund, Renaissance Technologies, also dumped its stock, about $10.6 million worth. These transactions are interesting, as total hedge fund interest fell by 4 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Healthcare Services Group, Inc. (NASDAQ:HCSG) but similarly valued. These stocks are Southwestern Energy Company (NYSE:SWN), Colony Capital Inc (NYSE:CLNY), Owens-Illinois Inc (NYSE:OI), and AllianceBernstein Holding LP (NYSE:AB). This group of stocks’ market valuations match HCSG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWN | 23 | 535096 | -1 |

| CLNY | 25 | 432608 | -3 |

| OI | 17 | 414672 | 1 |

| AB | 6 | 20685 | -3 |

| Average | 17.75 | 350765 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $351 million. That figure was $38 million in HCSG’s case. Colony Capital Inc (NYSE:CLNY) is the most popular stock in this table. On the other hand AllianceBernstein Holding LP (NYSE:AB) is the least popular one with only 6 bullish hedge fund positions. Healthcare Services Group, Inc. (NASDAQ:HCSG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CLNY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.