The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Hanesbrands Inc. (NYSE:HBI).

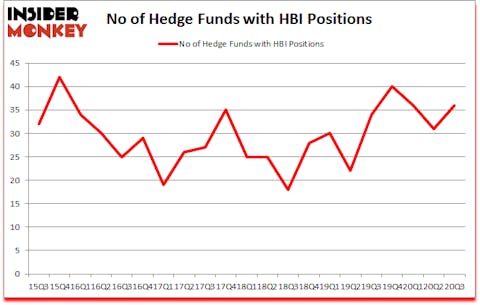

Is HBI a good stock to buy? The smart money was becoming more confident. The number of long hedge fund bets inched up by 5 in recent months. Hanesbrands Inc. (NYSE:HBI) was in 36 hedge funds’ portfolios at the end of September. The all time high for this statistic is 42. Our calculations also showed that HBI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 113% since March 2017 and outperformed the S&P 500 ETFs by more than 66 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to view the recent hedge fund action regarding Hanesbrands Inc. (NYSE:HBI).

Do Hedge Funds Think HBI Is A Good Stock To Buy Now?

At third quarter’s end, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 16% from the second quarter of 2020. On the other hand, there were a total of 34 hedge funds with a bullish position in HBI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Diamond Hill Capital, managed by Ric Dillon, holds the number one position in Hanesbrands Inc. (NYSE:HBI). Diamond Hill Capital has a $301 million position in the stock, comprising 1.7% of its 13F portfolio. The second most bullish fund manager is Lyrical Asset Management, managed by Andrew Wellington and Jeff Keswin, which holds a $220 million position; 4% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions comprise Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management and Principal Global Investors’s Columbus Circle Investors. In terms of the portfolio weights assigned to each position Lyrical Asset Management allocated the biggest weight to Hanesbrands Inc. (NYSE:HBI), around 4% of its 13F portfolio. Wallace Capital Management is also relatively very bullish on the stock, earmarking 2.57 percent of its 13F equity portfolio to HBI.

As one would reasonably expect, some big names were leading the bulls’ herd. Columbus Circle Investors, managed by Principal Global Investors, created the largest position in Hanesbrands Inc. (NYSE:HBI). Columbus Circle Investors had $33.8 million invested in the company at the end of the quarter. Mark Coe’s Intrinsic Edge Capital also made a $2.4 million investment in the stock during the quarter. The other funds with brand new HBI positions are James Dondero’s Highland Capital Management, Peter Muller’s PDT Partners, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Hanesbrands Inc. (NYSE:HBI). We will take a look at Emergent Biosolutions Inc (NYSE:EBS), Lincoln Electric Holdings, Inc. (NASDAQ:LECO), Leggett & Platt, Inc. (NYSE:LEG), Clearway Energy, Inc. (NYSE:CWEN), Yamana Gold Inc. (NYSE:AUY), Plug Power, Inc. (NASDAQ:PLUG), and SiteOne Landscape Supply, Inc. (NYSE:SITE). This group of stocks’ market valuations match HBI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EBS | 22 | 151540 | 1 |

| LECO | 24 | 266760 | 2 |

| LEG | 26 | 135068 | -3 |

| CWEN | 19 | 256069 | 0 |

| AUY | 17 | 296964 | -1 |

| PLUG | 21 | 389379 | 1 |

| SITE | 28 | 96129 | 10 |

| Average | 22.4 | 227416 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.4 hedge funds with bullish positions and the average amount invested in these stocks was $227 million. That figure was $771 million in HBI’s case. SiteOne Landscape Supply, Inc. (NYSE:SITE) is the most popular stock in this table. On the other hand Yamana Gold Inc. (NYSE:AUY) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Hanesbrands Inc. (NYSE:HBI) is more popular among hedge funds. Our overall hedge fund sentiment score for HBI is 85.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 33.3% in 2020 through December 18th and still beat the market by 16.4 percentage points. Unfortunately HBI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HBI were disappointed as the stock returned -7.3% since the end of the third quarter (through 12/18) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Hanesbrands Inc. (NYSE:HBI)

Follow Hanesbrands Inc. (NYSE:HBI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.