Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved dearly, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 20 S&P 500 stocks among hedge funds beat the S&P 500 Index by 4 percentage points so far in 2019. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of HarborOne Bancorp, Inc. (NASDAQ:HONE).

Hedge fund interest in HarborOne Bancorp, Inc. (NASDAQ:HONE) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare HONE to other stocks including Viomi Technology Co., Ltd (NASDAQ:VIOT), Corindus Vascular Robotics Inc (NYSE:CVRS), and Watford Holdings Ltd. (NASDAQ:WTRE) to get a better sense of its popularity. Our calculations also showed that HONE isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are dozens of indicators stock traders can use to size up publicly traded companies. A duo of the best indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outclass their index-focused peers by a solid amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a glance at the new hedge fund action surrounding HarborOne Bancorp, Inc. (NASDAQ:HONE).

What does smart money think about HarborOne Bancorp, Inc. (NASDAQ:HONE)?

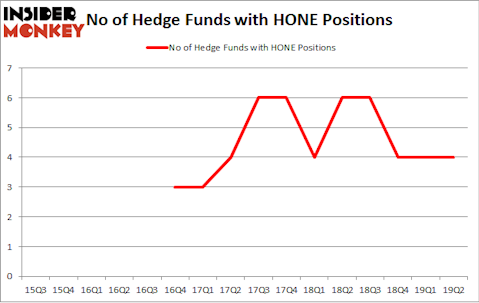

Heading into the third quarter of 2019, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in HONE over the last 16 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies holds the largest position in HarborOne Bancorp, Inc. (NASDAQ:HONE). Renaissance Technologies has a $5.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Royce & Associates, managed by Chuck Royce, which holds a $4.2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other professional money managers with similar optimism include John D. Gillespie’s Prospector Partners, Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners and .

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the second quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s go over hedge fund activity in other stocks similar to HarborOne Bancorp, Inc. (NASDAQ:HONE). We will take a look at Viomi Technology Co., Ltd (NASDAQ:VIOT), Corindus Vascular Robotics Inc (NYSE:CVRS), Watford Holdings Ltd. (NASDAQ:WTRE), and Comstock Resources Inc (NYSE:CRK). All of these stocks’ market caps are closest to HONE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VIOT | 3 | 24349 | 0 |

| CVRS | 9 | 143517 | 1 |

| WTRE | 3 | 2639 | 3 |

| CRK | 4 | 4186 | -4 |

| Average | 4.75 | 43673 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $44 million. That figure was $11 million in HONE’s case. Corindus Vascular Robotics Inc (NYSE:CVRS) is the most popular stock in this table. On the other hand Viomi Technology Co., Ltd (NASDAQ:VIOT) is the least popular one with only 3 bullish hedge fund positions. HarborOne Bancorp, Inc. (NASDAQ:HONE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately HONE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); HONE investors were disappointed as the stock returned -3.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.