It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards Halozyme Therapeutics, Inc. (NASDAQ:HALO) changed during the first quarter.

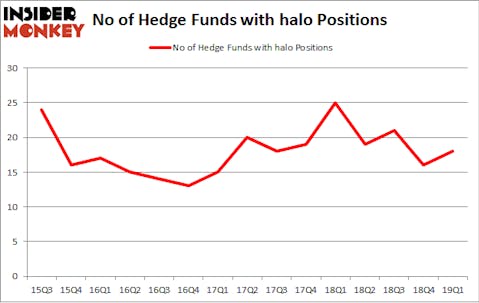

Is Halozyme Therapeutics, Inc. (NASDAQ:HALO) a good investment now? Prominent investors are taking an optimistic view. The number of bullish hedge fund positions improved by 2 lately. Our calculations also showed that halo isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the latest hedge fund action regarding Halozyme Therapeutics, Inc. (NASDAQ:HALO).

How have hedgies been trading Halozyme Therapeutics, Inc. (NASDAQ:HALO)?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the previous quarter. On the other hand, there were a total of 25 hedge funds with a bullish position in HALO a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Fisher Asset Management held the most valuable stake in Halozyme Therapeutics, Inc. (NASDAQ:HALO), which was worth $12.7 million at the end of the first quarter. On the second spot was GLG Partners which amassed $12.5 million worth of shares. Moreover, Renaissance Technologies, Citadel Investment Group, and D E Shaw were also bullish on Halozyme Therapeutics, Inc. (NASDAQ:HALO), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds have been driving this bullishness. Adage Capital Management, managed by Phill Gross and Robert Atchinson, established the most outsized position in Halozyme Therapeutics, Inc. (NASDAQ:HALO). Adage Capital Management had $2.4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $1 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP and David Costen Haley’s HBK Investments.

Let’s now take a look at hedge fund activity in other stocks similar to Halozyme Therapeutics, Inc. (NASDAQ:HALO). We will take a look at Bed Bath & Beyond Inc. (NASDAQ:BBBY), Aphria Inc. (NYSE:APHA), Centennial Resource Development, Inc. (NASDAQ:CDEV), and Zogenix, Inc. (NASDAQ:ZGNX). This group of stocks’ market caps are similar to HALO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBBY | 29 | 478941 | -1 |

| APHA | 9 | 8864 | 3 |

| CDEV | 15 | 127236 | 1 |

| ZGNX | 37 | 1112306 | 2 |

| Average | 22.5 | 431837 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $432 million. That figure was $74 million in HALO’s case. Zogenix, Inc. (NASDAQ:ZGNX) is the most popular stock in this table. On the other hand Aphria Inc. (NYSE:APHA) is the least popular one with only 9 bullish hedge fund positions. Halozyme Therapeutics, Inc. (NASDAQ:HALO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately HALO wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); HALO investors were disappointed as the stock returned -6.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.