The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB).

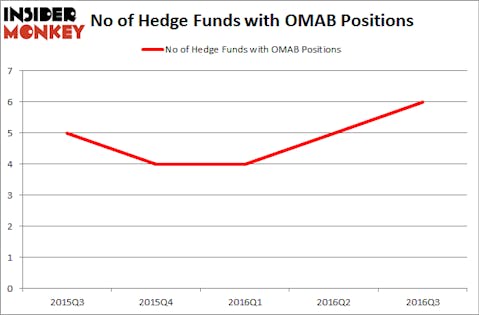

Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB) has experienced an increase in support from the world’s most successful money managers lately. OMAB was in 6 hedge funds’ portfolios at the end of September. There were 5 hedge funds in our database with OMAB holdings at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as HENNESS CAPITAL ACQUISITION CORP II (NASDAQ:HCAC), Ameresco Inc (NYSE:AMRC), and Old Second Bancorp Inc. (NASDAQ:OSBC) to gather more data points.

Follow Grupo Aeroportuario Del Centro N (NASDAQ:OMAB)

Follow Grupo Aeroportuario Del Centro N (NASDAQ:OMAB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Andrew Barker/Shutterstock.com

How have hedgies been trading Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a 20% rise from the previous quarter. On the other hand, there were a total of 4 hedge funds with a bullish position in OMAB at the beginning of this year, which has since risen by 50%. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the most valuable position in Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB). Renaissance Technologies has a $9.9 million position in the stock. The second most bullish fund manager is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $6.7 million position. Remaining professional money managers that hold long positions include Richard Driehaus’ Driehaus Capital, Israel Englander’s Millennium Management, and Mike Vranos’ Ellington. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Now, specific money managers have been driving this bullishness. Ellington assembled the most valuable position in Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB). Ellington had $0.2 million invested in the company at the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB). We will take a look at HENNESS CAPITAL ACQUISITION CORP II (NASDAQ:HCAC), Ameresco Inc (NYSE:AMRC), Old Second Bancorp Inc. (NASDAQ:OSBC), and The Bancorp, Inc. (NASDAQ:TBBK). All of these stocks’ market caps are closest to OMAB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HCAC | 15 | 45546 | -1 |

| AMRC | 7 | 8289 | 0 |

| OSBC | 4 | 19998 | -1 |

| TBBK | 11 | 64028 | 0 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $34 million. That figure was $24 million in OMAB’s case. HENNESS CAPITAL ACQUISITION CORP II (NASDAQ:HCAC) is the most popular stock in this table. On the other hand Old Second Bancorp Inc. (NASDAQ:OSBC) is the least popular one with only 4 bullish hedge fund positions. Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HCAC might be a better candidate to consider taking a long position in.

Disclosure: None