The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Golden Ocean Group Limited (NASDAQ:GOGL) based on those filings.

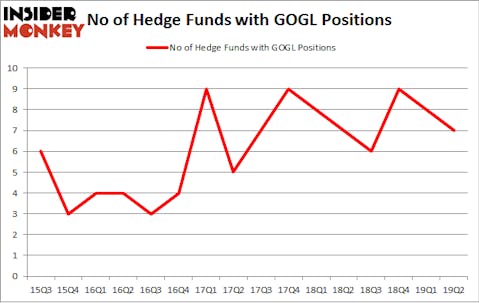

Is Golden Ocean Group Limited (NASDAQ:GOGL) going to take off soon? Hedge funds are taking a pessimistic view. The number of bullish hedge fund positions fell by 1 in recent months. Our calculations also showed that GOGL isn’t among the 30 most popular stocks among hedge funds (see the video below). GOGL was in 7 hedge funds’ portfolios at the end of June. There were 8 hedge funds in our database with GOGL positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are viewed as unimportant, old financial tools of years past. While there are greater than 8000 funds in operation at present, Our experts look at the elite of this group, around 750 funds. These money managers manage bulk of the smart money’s total capital, and by keeping an eye on their best equity investments, Insider Monkey has formulated a few investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the latest hedge fund action surrounding Golden Ocean Group Limited (NASDAQ:GOGL).

How are hedge funds trading Golden Ocean Group Limited (NASDAQ:GOGL)?

At Q2’s end, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in GOGL over the last 16 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Golden Ocean Group Limited (NASDAQ:GOGL) was held by Platinum Asset Management, which reported holding $165.4 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $10.7 million position. Other investors bullish on the company included Marshall Wace LLP, Millennium Management, and PDT Partners.

Seeing as Golden Ocean Group Limited (NASDAQ:GOGL) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few hedgies who sold off their full holdings by the end of the second quarter. At the top of the heap, John Overdeck and David Siegel’s Two Sigma Advisors dropped the largest position of the “upper crust” of funds watched by Insider Monkey, comprising an estimated $0.1 million in stock. Gavin Saitowitz and Cisco J. del Valle’s fund, Springbok Capital, also dropped its stock, about $0 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds by the end of the second quarter.

Let’s go over hedge fund activity in other stocks similar to Golden Ocean Group Limited (NASDAQ:GOGL). We will take a look at Principia Biopharma Inc. (NASDAQ:PRNB), Lindsay Corporation (NYSE:LNN), CNX Midstream Partners LP (NYSE:CNXM), and Qiwi PLC (NASDAQ:QIWI). This group of stocks’ market caps are closest to GOGL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRNB | 12 | 225860 | 1 |

| LNN | 6 | 175783 | -1 |

| CNXM | 5 | 12359 | -2 |

| QIWI | 13 | 105199 | 1 |

| Average | 9 | 129800 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $130 million. That figure was $186 million in GOGL’s case. Qiwi PLC (NASDAQ:QIWI) is the most popular stock in this table. On the other hand CNX Midstream Partners LP (NYSE:CNXM) is the least popular one with only 5 bullish hedge fund positions. Golden Ocean Group Limited (NASDAQ:GOGL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on GOGL, though not to the same extent, as the stock returned 1.9% during the third quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.