A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Golden Entertainment Inc (NASDAQ:GDEN) .

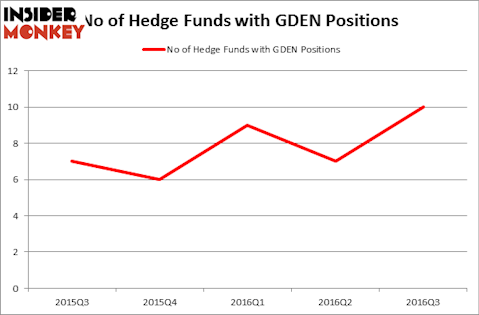

Is Golden Entertainment Inc (NASDAQ:GDEN) a bargain? Prominent investors are categorically buying. The number of bullish hedge fund investments strengthened by 3 lately. GDENwas in 10 hedge funds’ portfolios at the end of September. There were 7 hedge funds in our database with GDEN holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Seneca Foods Corp (NASDAQ:SENEA), Territorial Bancorp Inc (NASDAQ:TBNK), and Golden Star Resources Ltd. (USA) (NYSEAMEX:GSS) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Stefano Tinti / Shutterstock.com

With all of this in mind, we’re going to take a gander at the latest action regarding Golden Entertainment Inc (NASDAQ:GDEN).

Hedge fund activity in Golden Entertainment Inc (NASDAQ:GDEN)

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 43% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards GDEN over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Wilmot B. Harkey and Daniel Mack of Nantahala Capital Management holds the most valuable position in Golden Entertainment Inc (NASDAQ:GDEN). Nantahala Capital Management has a $11.8 million position in the stock, comprising 1.4% of its 13F portfolio. Coming in second is Jeffrey Bronchick’s Cove Street Capital holding a $5 million position. Other professional money managers with similar optimism include Bryant Regan’s Lafitte Capital Management, Jim Simons’ Renaissance Technologies which is one of the largest hedge funds in the world and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. We should note that Nantahala Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, key hedge funds have been driving this bullishness. Cove Street Capital created the most outsized position in Golden Entertainment Inc (NASDAQ:GDEN) which had $5 million invested in the company at the end of the quarter. Peter Algert and Kevin Coldiron’s Algert Coldiron Investors also made a $1.1 million investment in the stock during the quarter. The only other fund with a new position in the stock is Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s also examine hedge fund activity in other stocks similar to Golden Entertainment Inc (NASDAQ:GDEN). These stocks are Seneca Foods Corp (NASDAQ:SENEA), Territorial Bancorp Inc (NASDAQ:TBNK), Golden Star Resources Ltd. (USA) (NYSEAMEX:GSS), and San Juan Basin Royalty Trust (NYSE:SJT). All of these stocks’ market caps match GDEN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SENEA | 7 | 13548 | 0 |

| TBNK | 5 | 18671 | 0 |

| GSS | 9 | 13576 | 5 |

| SJT | 6 | 9223 | -1 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $14 million. That figure was $30 million in GDEN’s case. Golden Star Resources Ltd. (USA) (NYSEAMEX:GSS) is the most popular stock in this table. On the other hand Territorial Bancorp Inc (NASDAQ:TBNK) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Golden Entertainment Inc (NASDAQ:GDEN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Suggested Articles:

High Margin Products To Sell On eBay and Amazon

Biggest Gun Producing Countries

Recession-Proof Businesses You Can Start

Disclosure: None