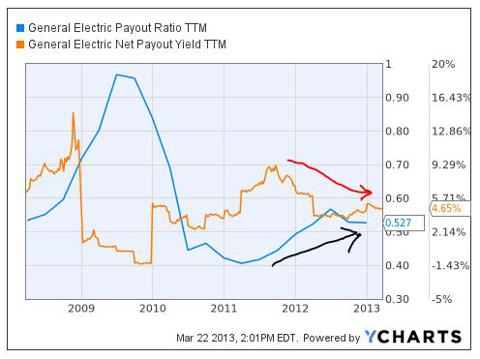

Moreover, if you look at the dividend yield graph below, it seems it has fallen over the last couple of years, even when the dividend payout ratio has gone up. That is just the effect of declining EPS over time. The question is what happens if the EPS further falls or stays stagnant at the current level for the next one year or so. I am apprehensive about a fall in stock price if that happens.

In other words, we cannot say that the company is going to crumble down, but more focus to asset utilization should be given.

Competitive Analysis

| Companies | P/E (TTM) | P/S | PEG | Debt/Equity | Quick Ratio | ROA % | Operating Margin % | Net Margin % |

| General Electric Company (NYSE:GE) | 18.08 | 1.65 | 1.23 | 1.84 | 2.85 | 2.31 | 10.9 | 9.26 |

| United Technologies Corporation (NYSE:UTX) | 16.5 | 1.47 | 1.12 | 0.8 | 0.84 | 6.57 | 9.04 | 8.89 |

| Siemens AG (ADR) (NYSE:SI) | 17.75 | 0.93 | 0.23 | 0.55 | 0.83 | 4.58 | 6.29 | 5.41 |

| Koninklijke Philips Electronics NV (ADR) (NYSE:PHG) | 95.9 | 0.86 | 16.24 | 0.33 | 0.91 | 3.96 | 4.82 | 0.96 |

| Citigroup Inc. (NYSE:C) | 18.53 | 2.32 | 0.82 | 1.27 | 1.01 | 0.62 | 15.01 | 9.51 |

| The Boeing Company (NYSE:BA) | 16.61 | 0.78 | 0.98 | 1.5 | 0.43 | 4.57 | 4.68 | 4.77 |

Valuation – While Koninklijke Philips Electronics NV (ADR) (NYSE:PHG)‘ PE ratio is too high to even consider, which is also the reason why Philips’ stock price fell by over 12% in the last 1 month, GE’s P/E ratio is more in line with the other competitors such as Siemens AG (ADR) (NYSE:SI). Moreover, with a 3.7% drop in healthcare sales and 2% in lighting revenue (two segments that generate 80% of Philips’ revenue), Philips’ first quarter of 2013 is already shaky, compared to General Electric Company (NYSE:GE). Although GE investors seem to be putting higher value on GE’s revenue, when compared with that of The Boeing Company (NYSE:BA), I would not say it is ‘off limits.’ With the recent Federal Aviation Administration (FAA) probe on the Boeing 737s and 787s, it is natural for Boeing investors to be rather wary of the future sales. It must be noted though that with the current P/E valuation, a lower PEG would have been better.

Leverage – Although GE’s debt/equity ratio at 1.84 is pretty higher than 0.8 of United Technologies, 0.55 of Siemens and 0.33 of Philips, the high quick ratio of 2.85 more than compensates for it. I would say that the company is still in a strong financial position.

Performance – Asset utilization looks pretty weak with ROA at 2.31%. Even though the profitability margins look good when compared to the rest, except Citigroup Inc. (NYSE:C), the couple of quarters ahead would be highly crucial in deciding whether the company is still profitable or not.

Conclusion

General Electric Company (NYSE:GE) shows growth potential. I would definitely not reject the popular analysts’ estimates. The strong fundamentals, the competitive edge and the global expansion of the company definitely promise future growth. Having said that, there is a strong need for the company to justify its capital expenditures. In other words, asset utilization is still an important yet undermined factor for GE. The next couple of quarters ahead will hopefully prove me wrong. For now, I am neutral about the company.

Ron Chatterjee has no position in any stocks mentioned. The Motley Fool owns shares of Citigroup Inc and General Electric Company.

The article I’m Not Too Positive About General Electric originally appeared on Fool.com and is written by Ron Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.